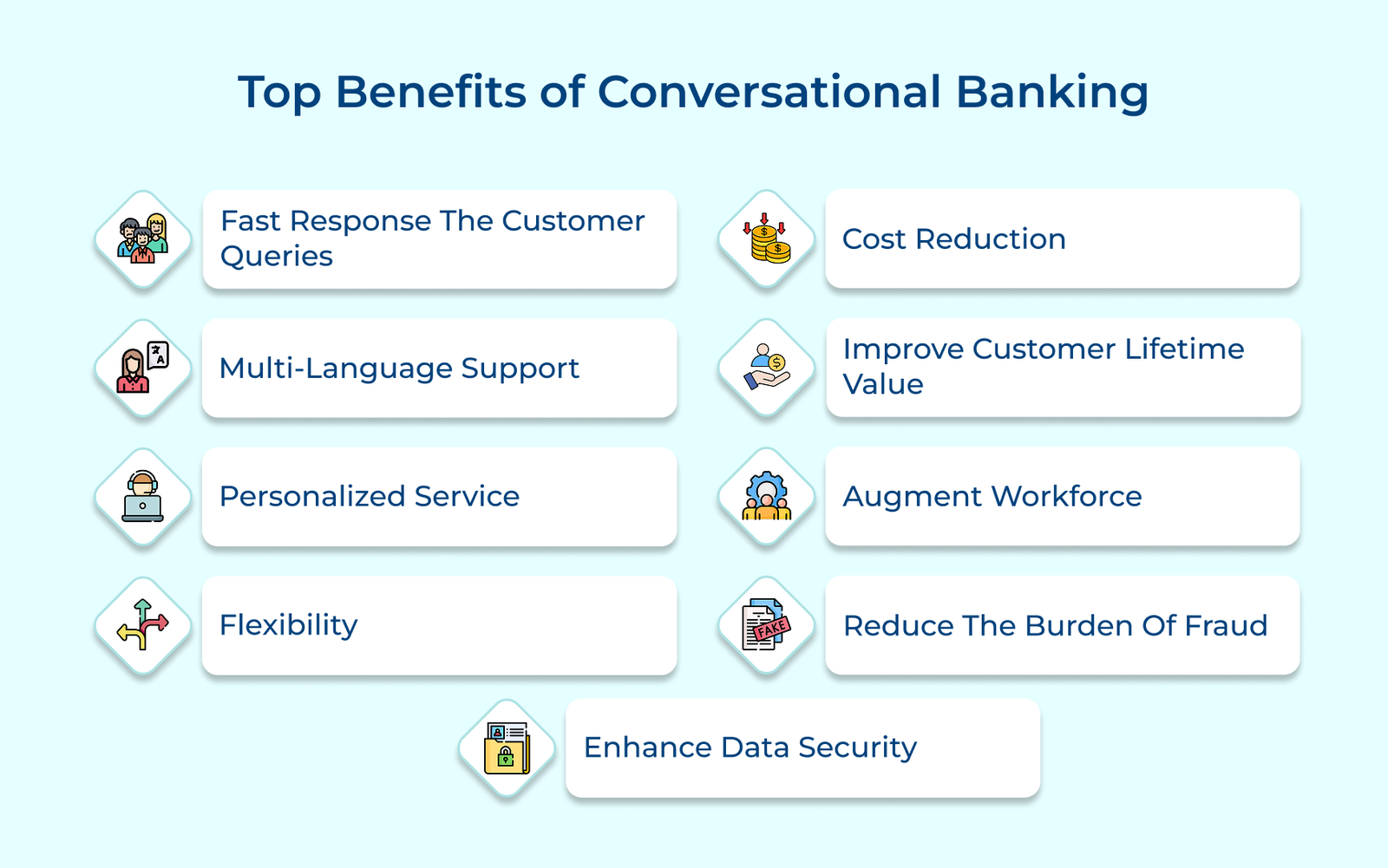

Benefits for Banking Customers

Discover how innovative banking solutions can streamline your financial life and help you achieve your goals.

1. Fast Response the Customer Queries

One of the key benefits of conversational AI banking is the fast response time to customer queries. No longer do customers have to wait on hold for a representative to be available. Customers can simply input their queries into a chat interface and receive instant responses with conversational AI. It allows for a more efficient and streamlined customer experience.

2. Multi-language Support

Interactive banking offers multi-language support, making it easier for customers who may speak different languages to interact with their bank. Whether a customer speaks English, Mandarin, or any other language, they can still receive the same level of support through conversational AI. It not only helps to break down language barriers but also helps to create a more inclusive banking experience.

3. Personalized Service

Conversational AI tools can analyze customer data in real-time, allowing banks to tailor their services. A significant 70% of consumers expect personalized advice from their banks. Customers can receive customized offers, support and advice, leading to a more positive banking experience. Conversational AI ensures that customers feel understood and valued by their bank by providing financial advice or suggesting relevant products.

4. Flexibility

Another significant benefit of conversational AI banking is the flexibility it provides to customers. Customers can access banking services at any time, from anywhere by using AI-powered chatbots and virtual assistants. The flexibility eliminates the need for customers to visit physical branches or wait on hold to speak with a representative, saving time.

Benefits for Financial Institutions

Learn how cutting-edge technology can enhance your operations, reduce costs, and drive customer satisfaction.

5. Cost Reduction

Cost reduction is a significant advantage for financial institutions implementing conversational AI. Automating routine tasks and customer interactions can help banks reduce the need for human agents. Chatbots can handle inquiries, provide account information and even assist with basic transactions, freeing up employees to focus on complex issues.

6. Improve Customer Lifetime Value

Another key benefit of conversational AI banking is the ability to improve customer lifetime value. Banks can enhance the customer experience by offering personalized and proactive interactions. Chatbots can provide tailored product offers, answer questions about financial goals and offer real-time assistance whenever customers need it.

7. Augment Workforce

One key benefit of AI-powered banking is the ability to augment the workforce. Financial institutions can handle a large volume of inquiries without the need for human intervention. Employees are allowed to focus on more complex tasks that require human judgment. Conversational banking ensures the benefit of providing personalized and real-time assistance to customers through natural language processing.

8. Reduce the Burden of Fraud

Conversational AI banking utilizes advanced technology to detect and prevent fraudulent activities. Chatbots can identify any suspicious behavior and alert the appropriate authorities by analyzing user data. The proactive approach helps financial institutions stay one step ahead of fraudsters and protect their customer’s sensitive information.

9. Enhance Data Security

Interactive banking ensures robust data security by encrypting all communication between the customer and the chatbot. The encryption safeguards sensitive details such as account numbers from unauthorized access. AI-powered chatbots are equipped with advanced authentication measures. Banks can instill trust in their customers and protect their data from cyber threats.

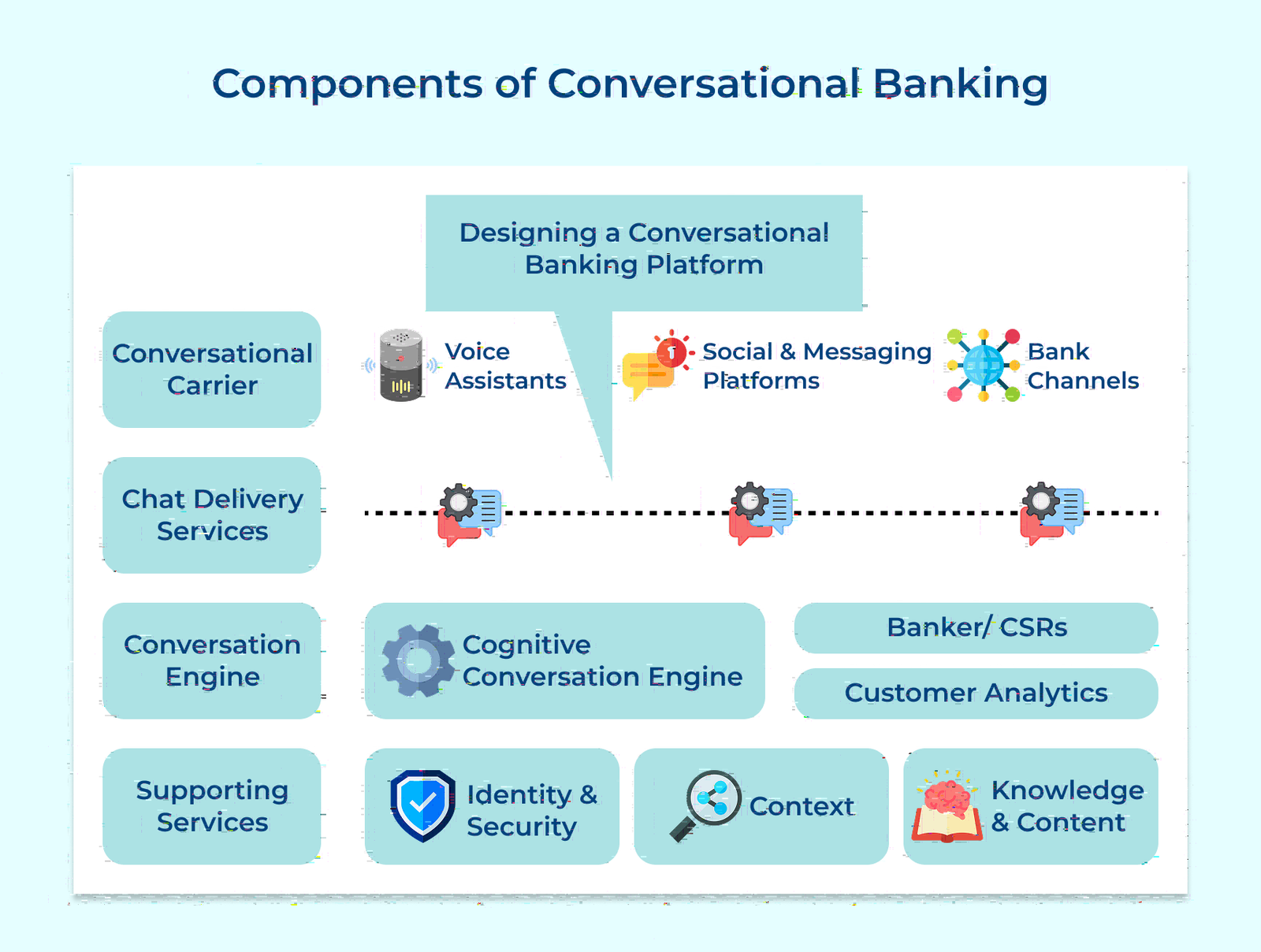

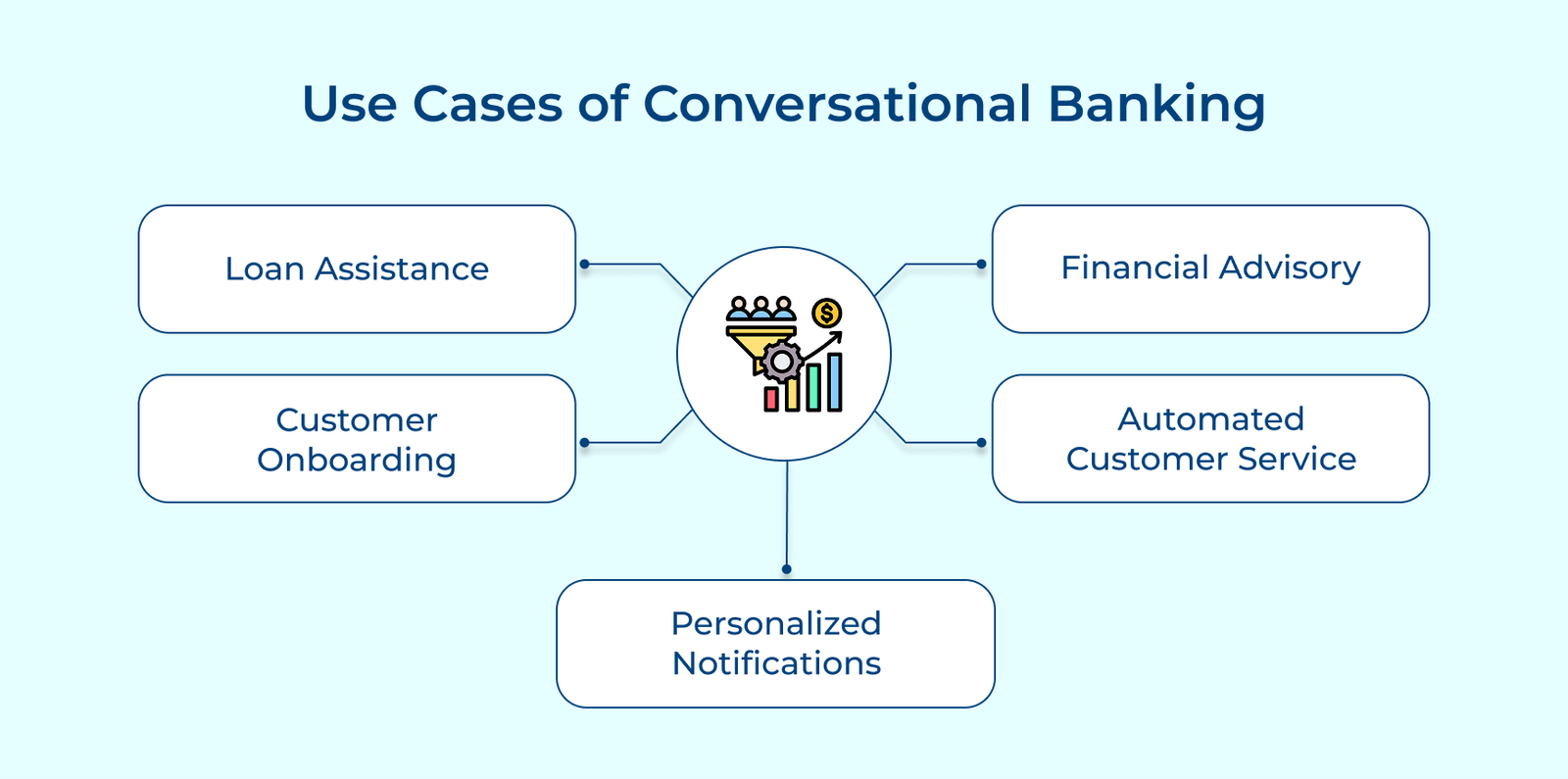

Steps to Build a Conversational Banking Experience

Implementing conversational banking involves several key steps to ensure you create a seamless conversational experience for your customers.