1. Identify and Prioritize Knowledge Assets

Knowledge management banking focuses on identifying and prioritizing knowledge assets to ensure that valuable information is utilized effectively. The practice allows banks to identify the key knowledge assets that they possess such as customer data, market insights and internal processes. It helps in prioritizing them based on their importance and relevance to the overall business goals.

Identifying and prioritizing knowledge assets is crucial in banking. It allows institutions to leverage their internal expertise, optimize decision-making processes and improve overall operational efficiency. Understanding what knowledge assets are most valuable enables banks to allocate resources effectively and focus on areas that will have the biggest impact.

Pro tips:

- Conduct regular knowledge audits to identify and categorize knowledge assets.

- Establish a knowledge asset registry to track and prioritize key information.

- Develop training programs to ensure that employees understand the value of knowledge assets and how to utilize them effectively.

2. Implement a Robust Knowledge Management System

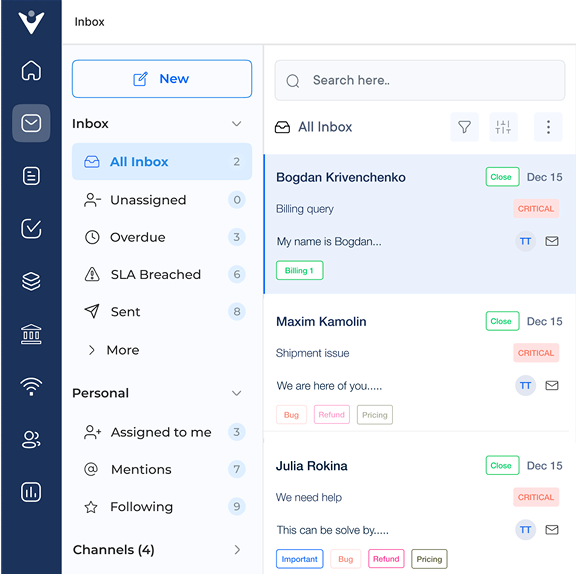

Knowledge management banking is crucial for maintaining competitiveness and delivering high-quality services to customers. One of the best practices in knowledge management in banking is to establish a comprehensive knowledge management system. It must include tools and processes for collecting, storing and accessing information.

A use case for implementing a robust knowledge management finance system in banking is to streamline the onboarding process for new employees. Centralizing training materials, policies and procedures in a knowledge management system allows banks to ensure that new hires have access to essential information.

Pro tips:

- Invest in a centralized knowledge management platform that allows for easy access and retrieval of information.

- Create a system for categorizing knowledge assets to improve searchability and organization.

- Encourage a culture of knowledge sharing and collaboration among employees to facilitate the transfer of expertise.

3. Encourage Knowledge Sharing and Collaboration

Knowledge management is essential for maintaining a competitive edge and providing exceptional service to customers. Encouraging knowledge-sharing and collaboration involves creating a culture where employees feel empowered to share their expertise. It is crucial because it allows banks to leverage the collective knowledge of their workforce.

A use case for implementing knowledge sharing and collaboration in banking could involve setting up a digital platform. The platform allows employees to share articles, case studies and best practices with one another. The platform could also include discussion forums and collaboration tools to facilitate communication.

Pro tips:

- Establish clear guidelines and incentives for knowledge sharing.

- Provide training on effective communication and collaboration techniques.

- Use technology tools to facilitate information exchange and collaboration among employees.

4. Regularly Update and Maintain Knowledge Assets

Knowledge management is crucial in the banking industry, where information is constantly changing and evolving. One of the best practices in knowledge management in banking is to regularly update and maintain knowledge assets. The practice involves keeping all information up-to-date, relevant and easily accessible to employees.

Continuously updating knowledge assets allows banks to ensure that their staff have the most current and accurate information at their fingertips. It leads to better decision-making and improved customer service. An example of the importance of this practice is in the case of regulatory changes in the banking industry. Banks must stay compliant with laws and regulations, which are constantly being updated.

Pro tips:

- Designate a knowledge management team responsible for regularly reviewing and updating knowledge assets.

- Utilize technology such as content management systems or knowledge bases to make it easier for employees to access and update information.

- Implement a training program for employees on how to effectively use and contribute to knowledge assets.

5. Provide Access to Knowledge Resources

Knowledge management is a crucial aspect of success in the banking industry, as the industry is constantly evolving with new regulations, technologies and customer demands. One key best practice in knowledge management banking provides access to knowledge resources for employees. Providing access to knowledge resources ensures that employees have the information and tools they need to make informed decisions.

The best practice allows for the sharing of insights and industry trends across the organization. A use case would be a centralized knowledge management system where employees can access training materials, policy updates and industry reports. The system would enable employees to stay up-to-date on the latest information and improve their overall knowledge base.

Pro tips:

- Create a digital knowledge repository that houses all relevant information in one easily accessible location.

- Implement regular training sessions and workshops to educate employees on how to effectively utilize knowledge resources.

- Encourage a culture of knowledge sharing and collaboration among employees to ensure information is disseminated effectively throughout the organization.

6. Monitor and Measure Knowledge Management Effectiveness.

Monitoring and measuring knowledge management effectiveness helps organizations track the impact of their knowledge management initiatives. It allows banks to assess whether their knowledge management efforts are achieving the desired outcomes and identify areas for improvement.

Let’s take an example of a bank that could track the usage of knowledge management tools and resources. It can track the response time to customer inquiries and employee satisfaction with knowledge-sharing practices to measure effectiveness.

Pro tips:

- Establish KPIs related to knowledge management such as the number of knowledge-sharing sessions held or the reduction in call resolution time.

- Regularly evaluate the impact of knowledge management initiatives through surveys, feedback sessions and data analysis to identify strengths.

- Utilize knowledge management analytics tools to measure knowledge sharing, collaboration and the impact on business outcomes.

7. Promotes a Culture of Continuous Learning

A culture of continuous learning is a crucial knowledge management best practice in the banking industry. The practice involves encouraging employees to constantly expand their knowledge, skill sets and expertise through various training programs. Staying up-to-date with the latest trends, technologies and regulations is paramount.

Promoting a culture of continuous learning allows banks to ensure that their employees are equipped with the necessary knowledge to provide excellent service to customers. One use case of implementing this best practice is through regular training sessions and workshops.

Pro tips:

- Create a learning and development program that offers a variety of training opportunities for employees.

- Encourage a culture of knowledge-sharing and collaboration within the organization.

- Provide incentives and recognition for employees who actively participate in continuous learning initiatives.

Examples of Knowledge Management Banking

Below are the standout examples of how banks are implementing knowledge management practices to maintain their competitive edge and deliver exceptional value to their customers.