1. Conversational Experiences will Become Forefront

Conversational experiences have quickly become the new norm in banking CX analytics. Customers expect seamless conversations that simplify their journey in banking. It allows for quick and easy access to the financial tools or services they need.

Ensure that your conversational experience is not just limited to simple chatbots but stretches across a wide range of digital channels. Utilize advanced technologies such as AI and machine learning to create personalized experiences that not only meet but exceed your customer’s expectations.

Best Practices:

- Use natural language processing and AI: Using natural language processing and AI allows the banks to create intelligent responses to provide quick solutions.

- Design a conversational interface: Banks should ensure that their conversational interface is intuitive, straightforward and easy to follow for better customer engagement.

- Integrate conversational experiences: Banks should ensure that they offer consistent conversational experiences across all channels. Customers should receive a seamless experience across any platform, be it online banking, mobile banking apps, or even physical branches.

2. AI will Drastically Improve Operational Efficiency

Banks are swiftly embracing digital transformation. AI technology has become increasingly influential in improving operational efficiency. One of the main advantages of AI is its ability to automate routine tasks, freeing up human agents to focus on high-stakes interactions with customers.

Banks have started using AI-powered chatbots to automate simple customer queries, schedule appointments and provide personalized responses. Chatbots work around the clock to provide immediate assistance to customers. A great banking chatbot interaction can improve the way your customers see your brand 72% of the time.

Best Practices:

- Start small: Begin by implementing AI technology for low-risk tasks. It would reduce the risk of failure and give the organization time to improve it before implementing it in more critical areas.

- Data is critical: Collect as much data as possible and use it to train the AI systems. AI can learn from past interactions and continuously improve its performance.

- Ensure human interaction remains: Create a balance between automated and human interactions in customer service. Even though AI will automate most of the tasks, human interaction might still be needed to handle complex scenarios.

3. Customer Will Want Omnichannel Engagement

Customers now expect a seamless and consistent experience across all channels. Implementing an omnichannel customer experience is no longer a luxury, but a necessity for banks to remain competitive and retain customers.

Customers interact with banks through different channels depending on their needs and preferences. Banks should analyze each customer’s journey and understand their preference for each channel. It will allow the banks to personalize their interactions and deliver an experience that builds customer loyalty.

Best Practices:

- Comprehensive view of customers: Analyze customer data from all channels, unify them and create a 360-degree view of customers. Banks will be able to provide personalized experiences that delight customers.

- Prioritize data security: Customers interact with banks through different channels and data security risks increase. Banks must prioritize data security across all channels to ensure customers’ confidential information is safeguarded.

- Continuous improvement: Continuously measure the omnichannel experience to get feedback from customers and improve it accordingly. Banks can use the insights to optimize the omnichannel experience.

4. Personalized CX to Drive Customer Journey

Providing a personalized experience to banking customers has become a crucial factor in driving customer journeys. Banks need to prioritize customer service by putting customers first and collecting their feedback to tailor services to their specific needs.

Banks can leverage customer data to understand their preferences and provide a multi-channel customer experience. The experience a user gets at the branches, phones, emails and messaging apps should always be as consistent as possible.

Best Practices:

- Monitor customer touchpoints: Banks need to monitor customer touchpoints across all channels and provide personalization at every step of the customer journey.

- Focus on customer needs: Banks should prioritize customers’ expectations and ensure that their preferences are met at every touchpoint.

- Measure the impact of improvements: Banks should keep checking if the changes they make to make customers’ experiences better are really working. Keep an eye on customers’ feedback and data to ensure everything is on the right track.

5. Sentiment Analysis to Make Data-Driven Decisions

Sentiment analysis is quite a powerful tool for making data-driven decisions, especially when it comes to improving customer experience in retail banking. Analyzing customer feedback and patterns in sentiment allows the banks to better understand the needs of their customers.

Determine the channels to analyze, such as social media, customer support, or surveys and ensure that they are representative of the customer base. Use a software tool that can process customer feedback and categorize it into sentiments to make analysis more efficient.

Best Practices:

- Set up automated alerts: Set up automated alerts to receive notifications when the sentiment score for a particular product or service falls below a certain threshold.

- Conduct root cause analysis: Conduct a root cause analysis to identify the underlying reasons behind negative sentiment scores and find ways to address them at the root level.

- Use data to inform decisions: Use the insights from sentiment analysis to guide decision-making and improve the customer experience, whether it’s by changing a policy or procedure or updating the solutions.

6. Adapting Real-Time Customer Service

Customers of today expect immediate assistance when they encounter an issue with a product or service. More than 65% of customers expect real-time support, making it essential for businesses to provide quick and efficient customer assistance. Real-time customer service is a solution that can be implemented in numerous ways.

Implementing chatbots allows customers to receive assistance anytime, anywhere. Chatbots also reduce wait times and provide immediate solutions that can save resources for everyone. Self-service options can also be used to give immediate assistance to the customers.

Best Practices:

- Measure customer sentiments: Banks must track customer sentiment to monitor customer satisfaction levels. Analyzing sentiment can help identify areas where improvement is required.

- Maintain high service standards: While offering real-time support is beneficial, it’s essential to maintain high levels of service across all channels to build meaningful relationships with customers.

- Striking the right balance: Businesses should strive to find a balance between self-service and assisted customer service to solve problems quickly.

How To Improve The Customer Experience In Banking?

Below are the key strategies and practices that industry leaders are embracing to not only meet but exceed customer expectations in banking.

1. Use Self-Service to Scale

One of the most efficient ways to enhance the customer experience in banking is by implementing self-service options. Self-service solutions allow customers to perform routine transactions and access information without the need for assistance from a bank representative. It can include features such as online banking, mobile banking apps, and interactive voice response systems.

Empowering customers to handle their own banking needs helps banks reduce wait times, improve efficiency and provide 24/7 access to services. Self-service options can free up bank staff to focus on more complex customer inquiries or problem resolutions. Approximately 60% of customers say they are very or somewhat interested in using a digital-only bank in the next year.

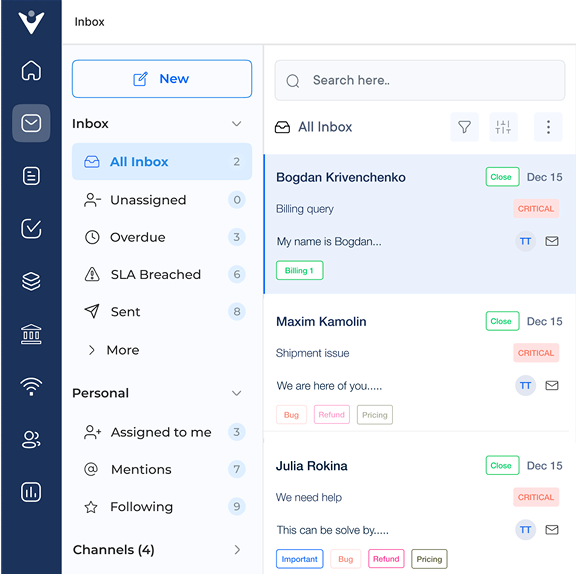

2. Modernize the Contact Center

The contact center plays a vital role in providing customer support and handling inquiries. Modernizing the contact center with advanced technology and tools is an excellent way to improve the customer experience. Implementing customer relationship management (CRM) systems that integrate with other key banking platforms can provide agents with a comprehensive view of customer history, preferences and needs. It will enable more personalized and efficient communication with customers.

Leveraging artificial intelligence (AI) and chatbot technologies can enhance customer interactions by providing instant responses to common queries. A modernized contact center ensures that customers receive timely and accurate assistance, leading to increased satisfaction.

3. Make it Easy for Customers to Get Instant Help

Promptly addressing customer inquiries and concerns is paramount for an exceptional customer experience. Banks should strive to make it as easy as possible for customers to get instant help when they need it. Implementing live chat support on the bank’s website or mobile app allows customers to communicate with bank representatives in real time.

The instant assistance can provide immediate answers to questions, resolve issues quickly and offer personalized recommendations. Offering multiple channels for customer support ensures that customers can reach out through their preferred method. Prioritizing quick and efficient customer support allows banks to build trust, loyalty and a positive reputation in the industry.

How AI & Technology to Drive Digital Banking Customer Experience Transformation

Artificial Intelligence (AI) has revolutionized the way banks operate and interact with customers. Banks can transform the digital banking customer experience by creating personalized experiences for customers in the financial services sector.

Leveraging AI-powered customer service and chatbots allows banks to deliver an efficient service to customers. Banks such as Bank of America and HSBC have successfully implemented AI-powered customer service, enabling them to enhance customer experience.

AI can be used for sentiment analysis to gain insights and make data-driven decisions. Analyzing customer feedback and behavior allows banks to gain a better understanding of their customers’ behavior.