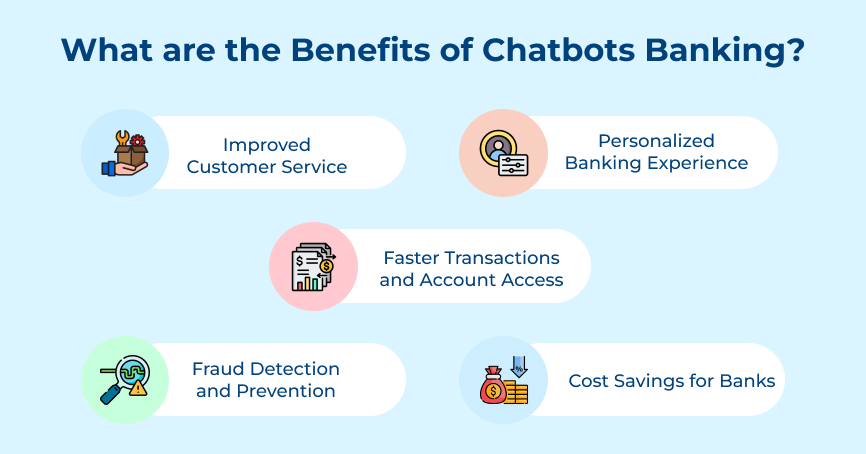

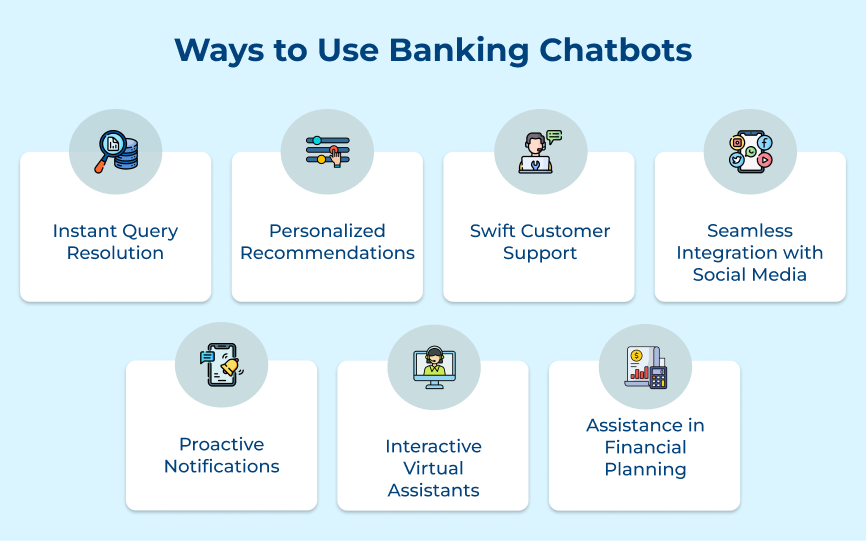

1. Instant Query Resolution

Imagine your users can find the answer to their banking questions instantly, without having to wait on hold or navigate through a lengthy website. Banking chatbots have made it a reality. About 90% of customer queries are resolved in 10 messages or fewer. Instant query resolution enables conversational banking chatbots to provide immediate answers to customer queries or concerns.

Let’s say a customer wants to know their current account balance. Instead of having to search through the bank’s website or call a customer service representative, they can simply chat with a banking chatbot to receive an instant response with their account balance. The seamless experience not only saves time but also enhances the customer’s trust in the bank.

Pro tips:

- Train the chatbot with a comprehensive knowledge base to provide accurate and up-to-date information.

- Enable natural language processing to understand and respond to customer queries conversationally.

- Implement a seamless transition to a human agent if the query goes beyond the capabilities of the chatbot.

2. Personalized Recommendations

Personalized recommendations involve leveraging customer data and AI algorithms to suggest tailored banking solutions, products, or services based on the individual customer’s preferences. When a chatbot is capable of understanding and catering to the specific needs of each customer. It not only improves their overall satisfaction but also builds trust and loyalty towards the bank.

Think of a customer who frequently uses their banking app for online shopping. The chatbot can analyze their transaction history and suggest a credit card or loyalty program that offers additional benefits. The personalized recommendation not only adds value to the customer’s experience but also encourages them to explore and engage with the bank’s offerings.

Pro tips:

- Group bank customers based on their similarities and tailor recommendations accordingly.

- Consider the customer’s current situation, such as their financial goals or recent transactions, to provide more relevant recommendations.

- Regularly update and improve AI algorithms to enhance the effectiveness of personalized recommendations.

3. Swift Customer Support

Customers now expect quick and efficient support, it is where swift customer support comes into play as a game-changer. It utilizes banking chatbots or digital assistants to enhance customer engagement and satisfaction. The users are provided with instant access to banking services and support 24/7. It enhances the customer satisfaction while saving the time and effort for both the parties.

One great example of swift customer Support in action is BankBot. BankBot is a banking chatbot that uses artificial intelligence to provide a seamless banking experience. Customers can interact with BankBot through various messaging platforms like Facebook Messenger or WhatsApp. It assists users with account inquiries, money transfers, bill payments and even provides financial advice.

Pro tips:

- Customize the chatbot’s responses and recommendations based on the individual customer’s preferences.

- While chatbots can handle most queries, there should always be an option for customers to talk to a human representative if they require further assistance.

- Ensure the chatbot’s interface is user-friendly and easy to navigate, minimizing any potential confusion.

4. Seamless Integration with Social Media

Seamless integration with social media allows banking chatbots to leverage the power of social media networks to create a more personalized and interactive customer experience. Chatbots can reach customers where they spend a significant amount of their time by integrating with platforms such as Facebook Messenger or WhatsApp. Customers can inquire about their account balances, transfer funds or even report lost cards through such platforms.

An example of seamless integration with social media in banking can be seen in the collaboration between Bank of America and Facebook Messenger. The users of Bank of America customers can easily access their account information, receive personalized notifications and even make seamless peer-to-peer payments, all within the Facebook Messenger app.

Pro tips:

- Design a chatbot that aligns with the brand’s voice and tone to maintain consistency across all communication channels.

- Utilize APIs and software development kits (SDKs) to connect your chatbot with social media platforms securely.

- Personalize interactions by using customer data gathered through social media platforms to provide tailored suggestions and recommendations.

5. Proactive Notifications

More than 60% of bank customers interact with their institution’s digital channels every week. Proactive notifications through chatbots will help banks reach out to customers with timely and relevant information without the need for customers to initiate the conversation. Proactive notifications also help in reducing customer complaints and inquiries. The customers are kept informed about their account activity, transactions and any potential security threats.

A banking chatbot can send proactive notifications to customers about their upcoming loan payments or credit card bill due dates. It also offers personalized suggestions for investment opportunities based on the customer’s financial goals and risk tolerance. The chatbot becomes a trusted financial advisor, keeping customers engaged and informed about their banking needs.

Pro tips:

- Tailor notifications based on customer preferences, demographics and behavior to maximize engagement.

- Send notifications at appropriate times to avoid being intrusive or overwhelming.

- Provide customers with the ability to opt out of notifications to respect their preferences and privacy.

6. Interactive Virtual Assistants

IVAs are computer programs designed to simulate human conversation and provide assistance to users in various tasks, including banking. IVAs can handle a wide range of customer queries, such as account balances, transaction history, fund transfers and bill payments. They make sure the customers are well-supported and satisfied with their banking experience by offering instantaneous responses.

An exemplary case of IVAs transforming customer engagement in the banking sector is Bank of America’s virtual assistant, Erica. Erica is an AI-powered chatbot that enables customers to easily manage their finances. The ability to understand natural language and provide personalized recommendations has made Erica a trusted financial advisor for millions of Bank of America customers.

Pro tips:

- Ensure the IVA understands and responds accurately to user queries, even in complex or colloquial language.

- Regularly improve the IVA’s knowledge base to keep up with evolving customer needs and industry trends.

- Integrate the IVA with various communication channels to provide a seamless and consistent experience for customers.

7. Assistance in Financial Planning

Industries across the board are finding new ways to improve customer engagement through the use of chatbots. Digital chatbot banking allows individuals to easily access information about various financial products, investment options and savings strategies. It not only saves time for customers but also ensures that they receive accurate and up-to-date information.

One example of how banking chatbots improve customer engagement in financial planning is through their ability to offer real-time advice. Chatbots can analyze a customer’s financial data and provide customized recommendations based on their unique financial situation. The level of personalized assistance not only helps customers make informed decisions but also facilitates a sense of loyalty toward the bank.

Pro tips:

- Ensure the chatbot is easy to navigate, providing clear instructions and options to customers.

- Regularly update the chatbot with the latest financial information and market trends to provide relevant advice.

- Provide customers with the option to connect with a human advisor for more complex or sensitive financial matters.

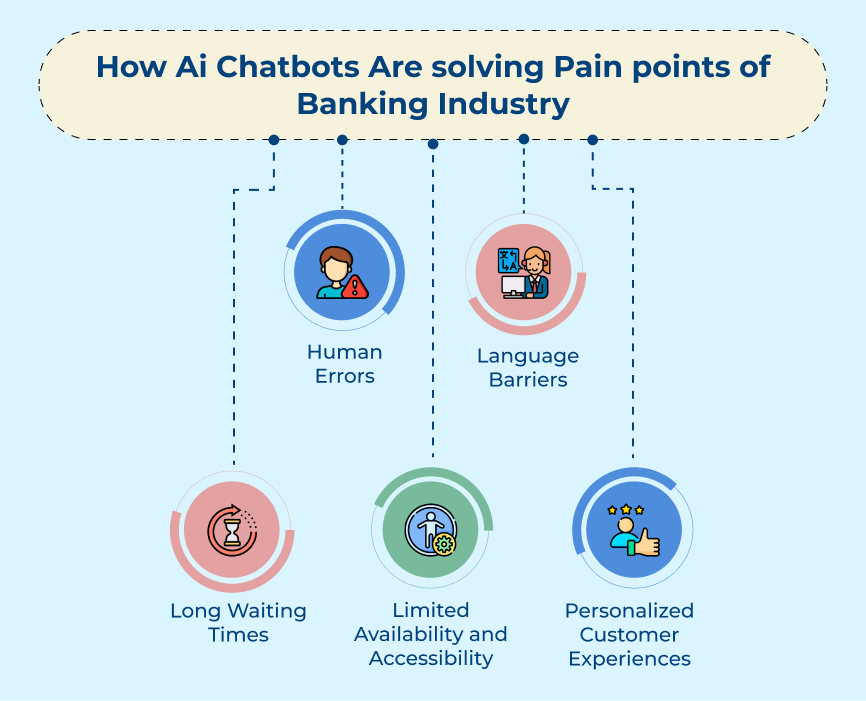

AI Chatbots Banking: How Does it Solve the Pain Points of the Banking Industry?

Let’s explore how AI-driven chatbots are solving key pain points in the banking industry and revolutionizing the customer experience.