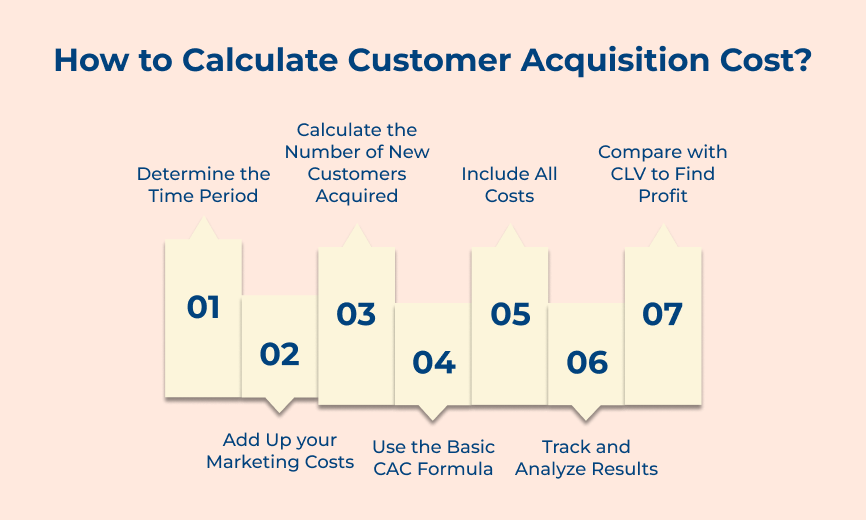

1. Determine the Time Period

When calculating the customer acquisition cost (CAC), step 1 is crucial: determining the time period over which you want to calculate the metric. The time you choose will have a significant impact on your CAC calculation. It will help you accurately evaluate the effectiveness of your marketing efforts.

Different periods that you can consider are:

- Monthly

- Quarterly

- Annually

Determining the right period depends on your business goals and the frequency at which you acquire new customers. Let’s assume that if your marketing campaigns are seasonal, you may want to calculate CAC every quarter to account for fluctuations in customer acquisition.

Pro tips:

- If your sales cycle is longer, consider calculating CAC over a longer period to accurately reflect the costs associated with acquiring new customers.

- Calculating CAC over different periods can help identify trends in your acquisition costs and make informed decisions about your marketing strategies.

- If your business experiences seasonal fluctuations, adjust your period to account for the variations and get a more accurate picture of your CAC.

2. Add Up your Marketing Costs

Calculating your CAC is an essential step in determining the effectiveness of your marketing efforts. One key component of calculating your CAC is adding up your marketing costs. You will need to account for all expenses related to acquiring customers to add up your marketing costs. It includes costs like advertising expenses, marketing tools, salaries of team members and any other expenses.

The formula for calculating your marketing cost is:

Total marketing expenses / Number of customers acquired = Customer Acquisition Cost

Let’s consider that if your total marketing expenses for a month amounted to $10,000 and you acquired 100 customers during that month, your CAC would be $100.

Pro tips:

- Keep detailed records of all marketing expenses to ensure accuracy in your calculations.

- Regularly review and analyze your marketing costs to identify areas where you can optimize spending.

- Compare your CAC to industry benchmarks to gauge the efficiency of your marketing efforts.

3. Calculate the Number of New Customers Acquired

Calculating the number of new customers acquired is a crucial step in determining the Acquisition Cost for a business. A company can evaluate the effectiveness of its marketing strategies by knowing how many new customers were acquired within a specific period.

The formula to calculate the number of new customers acquired is quite simple:

Number of new customers acquired = Total number of customers at the end of the period – Total number of customers at the beginning of the period

Let’s assume that a company had 500 customers at the beginning of the month and 600 customers at the end of the month. The number of new customers acquired would be 100.

Pro tips:

- Keep detailed records of customer data to accurately track customer acquisition.

- Compare the number of new customers acquired with your marketing strategies to determine which efforts are the most successful in bringing in new customers.

- Use customer relationship management (CRM) tools to automate the tracking of new customer acquisitions for better efficiency.

4. Use the Basic Customer Acquisition Cost Formula

Calculating cost per user acquisition involves dividing the total marketing expenses by the number of new customers acquired. The step is crucial in determining the effectiveness of your marketing efforts and understanding the cost associated with acquiring each new customer.

The formula for calculating customer acquisition cost is simple: CAC = Total Marketing Expenses / Number of New Customers Acquired.

Let’s consider that, if a company spent $10,000 on marketing and acquired 100 new customers, the CAC would be $100.

Pro tips:

- Ensure accurate tracking of marketing spend and new customer acquisition to get precise CAC calculations.

- Regularly review CAC to identify trends and make adjustments to marketing strategies as needed.

- Compare CAC across different marketing channels to determine which ones are the most cost-effective for acquiring new customers.

5: Include All Costs

Including all costs associated with acquiring a new customer is crucial in the process of calculating customer acquisition cost. The step is essential to ensure that your calculations are accurate and provide a clear picture of the true cost of acquiring a customer.

After calculating CAC, including all costs helps you understand the total investment required to acquire a customer. Including all costs can help identify areas where you may be overspending or where you may need to allocate more resources.

Indirect costs that need to be added when calculating CAC include:

- Overhead expenses

- Salaries of employees involved in the acquisition process

Other costs not directly attributed to a specific marketing campaign.

Failure to account for the costs may result in an inaccurate representation of your true CAC. Let’s consider that you are running a digital marketing campaign to acquire new customers. You need to consider not only the cost of the actual advertising but also expenses related to other areas. It can involve creative development, website optimization and campaign management.

Pro tips:

- Keep detailed records of all expenses related to customer acquisition, including both direct and indirect costs.

- Regularly review your cost calculations to ensure accuracy and identify areas for potential cost savings.

- Consider using an acquisition cost calculator to streamline the process and ensure all costs are accounted for accurately.

6. Track and Analyze Results

Tracking and analyzing results allows you to see which marketing channels are most effective in acquiring new customers. The information is essential for calculating CAC because it helps you determine the cost per acquisition for each channel. You can optimize your marketing strategy and budget by knowing how much it costs to acquire a customer through different channels.

Let’s assume that you spend $1,000 on a social media advertising campaign that results in 50 new customers. Your CAC for that campaign would be $20 ($1,000 divided by 50 customers). Tracking the results of the campaign can help see if the cost per acquisition is within your target range. It can also help make adjustments for future campaigns.

Pro tips:

- Use tracking tools such as Google Analytics or social media insights to monitor the performance of your campaigns in real-time.

- Segment your results by channel to identify which channels are most effective in acquiring new customers.

- Continuously test your campaigns to improve their performance and reduce your CAC over time.

7. Compare with Customer Lifetime Value to Find the Profit

Calculating cost per user acquisition involves comparing the CAC with the customer lifetime value (CLV) to determine the profitability of acquiring a new customer. It is crucial to understand the ROI and make informed decisions about marketing strategies.

The importance of the step lies in ensuring that the cost of acquiring a new customer does not exceed the potential revenue that customers will generate over their lifetime. Comparing the CAC with the CLV can determine whether their marketing campaigns are cost-effective.

Let’s consider that if the CAC is significantly higher than the CLV, it may indicate that you need to focus on retaining existing customers to improve profitability. If the CAC is $50 and the CLV is $200, then the business is making a profit of $150 per customer.

Pro tips:

- Continually track your CAC and CLV to ensure they remain in alignment.

- Experiment with different marketing channels and campaigns to find the most cost-effective ways to acquire customers.

- Consider implementing retention strategies to increase the CLV and maximize profitability.

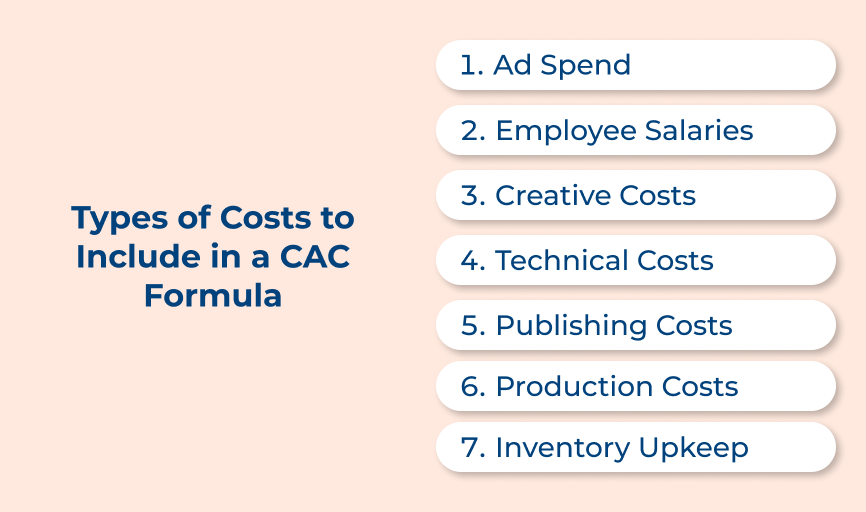

Types of Costs to Include in a CAC Formula

Let’s check out the key types of costs that should be included in the CAC calculation to help brands fine-tune their customer acquisition strategy: