What is Customer Equity: Importance, Components & Tactics

Customer equity refers to the total lifetime value of a company's customer base. It's the sum of all present and future values derived from customer relationships.

Customer equity refers to the total lifetime value of a company's customer base. It's the sum of all present and future values derived from customer relationships.

What is the true value of a loyal customer to a business? Customer equity is a key metric that measures the total lifetime value of a company’s customer base. It goes beyond just acquisition costs and takes into consideration long-term profitability.

Maintaining strong customer relationships with customers is essential for sustainable growth as 74% of consumers are at least somewhat likely to buy based on experiences alone. Understanding the concept of user equity allows businesses to better allocate resources and tailor marketing strategies to maximize their customer’s value.

Consumer equity is a critical factor in determining the success of a business. Here we will explore the importance of equity, how it is calculated and strategies to increase or retain equity to drive long-term profitability.

Customer equity is defined as the total lifetime value that all your customers will bring to your business over time. Think of it as measuring the collective worth of your entire customer base – not just what they spend today but what they’ll contribute throughout their entire relationship with your company. It’s essentially your customers viewed as valuable assets rather than just transaction sources.

The approach works by calculating three core components : value equity (what customers get for their money), brand equity (emotional connection to your brand) and retention equity (switching costs and loyalty programs). Companies build equity by consistently delivering superior value while creating strong emotional bonds and practical reasons for customers to stay. The stronger these three pillars become the more valuable your customer base grows over time.

Key principles:

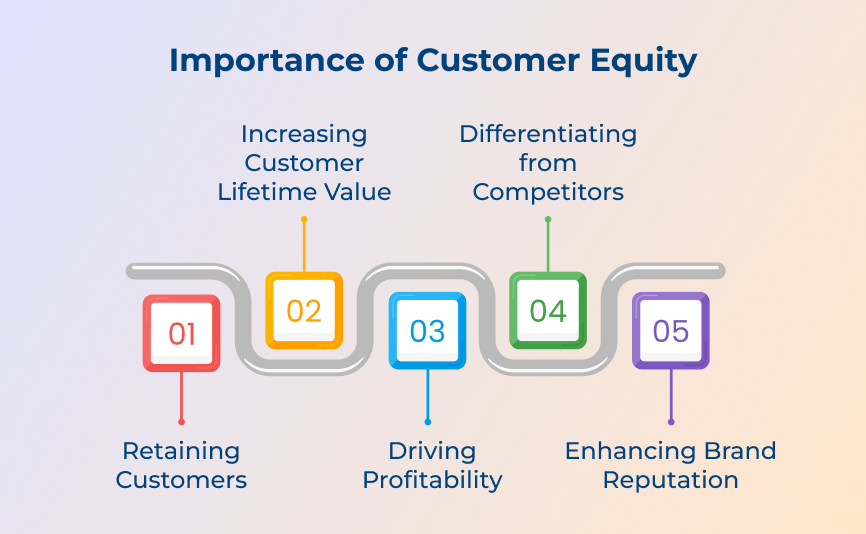

Let us understand why customer equity is pivotal for businesses looking to create a loyal customer base and drive profitability.

Customer equity emphasizes the importance of retaining customers over time. It is more cost-effective to retain existing customers than to acquire new ones. Loyal customers are likely to make repeat purchases and generate higher lifetime value for the company.

Consumer equity helps companies understand the lifetime value of customers and how they can increase this value through marketing strategies. Focusing on building strong relationships with customers and meeting their needs allows companies to increase customer loyalty.

Customer equity is directly linked to a company’s profitability. Focusing on customer satisfaction allows companies to increase equity. It drives profitability through repeat purchases, referrals and positive word-of-mouth marketing.

Customer equity can be a valuable source of competitive advantage for companies. Building strong relationships with customers and delivering exceptional customer experiences allows companies to differentiate themselves. It creates a loyal customer base that is less likely to switch to a competitor.

Building strong consumer equity can enhance a company’s brand reputation and credibility in the market. Satisfied customers are more likely to recommend the company to others and speak positively about their experiences. It helps to build a positive brand image and attract new customers.

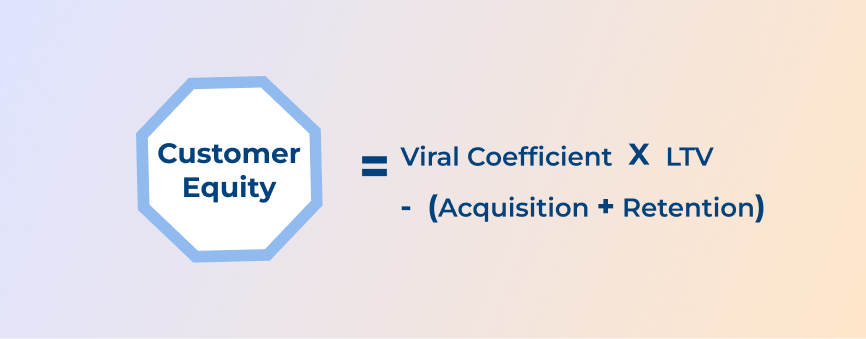

Let us go through the customer equity formula, break down its components and guide you through the calculation process to ensure you harness the full potential of your customer relationships.

The formula for Calculating Equity:

Customer Equity = Average Revenue Per Customer x Average Customer Lifespan

Steps to Calculate Consumer Equity:

Step 1: Determine the Average Revenue Per Customer: Begin by calculating the total revenue earned from all customers over a specific period (e.g., month, quarter, year). Divide this total revenue by the number of customers during that period to determine the Average Revenue Per Customer.

Step 2. Calculate the Average Customer Lifespan: Businesses can analyze customer retention rates or average customer length of time as a customer to calculate the Average Customer Lifespan. It can be determined by looking at the time period that customers typically remain engaged and active with the business.

Step 3. Multiply Average Revenue Per Customer by Average Customer Lifespan: After determining the Average Revenue Per Customer and Average Customer Lifespan, multiply these two values to calculate customer equity.

Example:

Let’s say a business has an Average Revenue Per Customer of $500 and an Average Customer Lifespan of 3 years. The equity can be calculated by multiplying these two values as follows:

Customer Equity = $500 x 3 years

Consumermer Equity = $1500

Here the equity for the business is $1500. It means that each customer contributes $1500 in revenue to the business for their relationship.

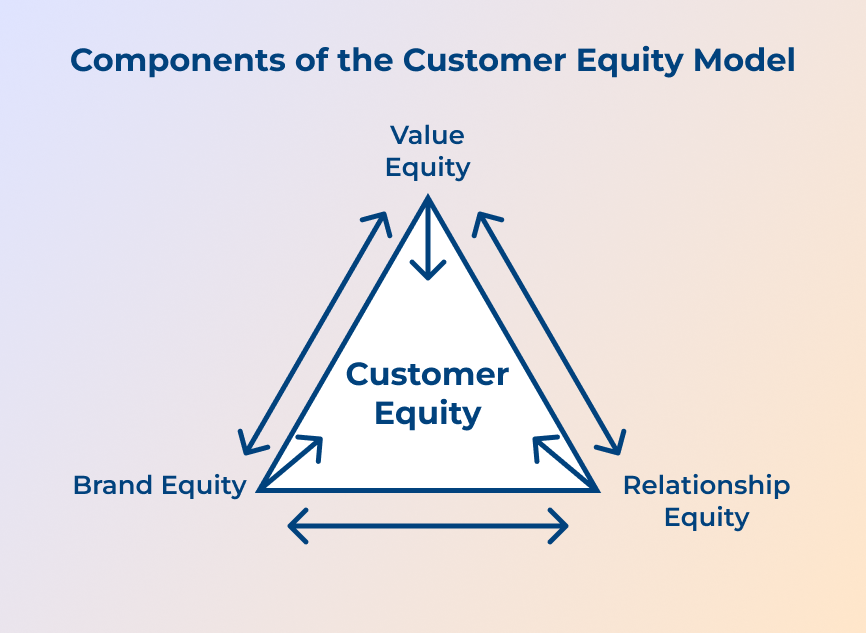

Below, we have unraveled the intricacies of the customer equity model to provide a clearer picture of the essential elements that contribute to customer retention and brand loyalty.

Value equity refers to the perception of fair value by customers for the solution offered by a company. The component focuses on the benefits customers receive in exchange for their money.

Offering high-quality products or services at a competitive price allows businesses to create value equity with their customers. Let’s take an example of how Apple has built strong value equity by consistently delivering innovative products with cutting-edge technology at a premium price point.

Brand equity refers to the value that a brand adds to a product beyond the functional benefits it offers. The component encompasses factors such as brand recognition, reputation and emotional connection with customers.

Strong brand equity can result in customers choosing a particular brand over competitors, even if the price is higher. An example of a brand with high brand equity is Coca-Cola. Coca-Cola has built a strong emotional connection with consumers through its marketing campaigns and brand image.

Relationship equity focuses on the strength of the relationship between a brand and its customers. The component considers factors such as customer satisfaction, trust and loyalty.

Providing excellent customer service, personalized communication and consistent engagement allows businesses to build strong relationship equity. Let’s look at an example of how Amazon has built a loyal customer base. They are known for their efficient delivery, personalized recommendations and easy returns.

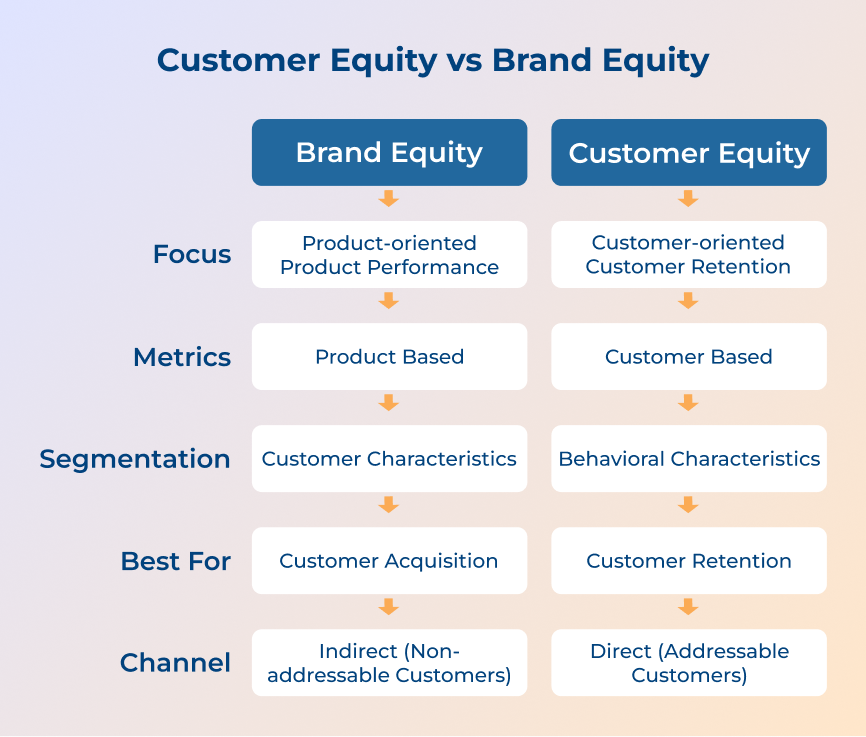

Dive into our exploration of customer equity vs brand equity to uncover how each plays a pivotal role in shaping a brand’s legacy and financial success.

Customer equity is more focused on the individual customer and their relationship with the company. It looks at factors such as how much a customer spends, how often they purchase and how long they remain loyal to the brand.

Brand equity is focused on the overall perception and awareness of the brand in the marketplace. It looks at factors such as brand recognition, reputation and associations.

Customer equity can be measured through metrics such as customer lifetime value, customer acquisition cost and customer retention rates. The metrics help companies understand the financial value of their customer relationships.

Brand equity can be measured through metrics such as brand awareness, brand loyalty and brand preference. These metrics help companies understand the strength of their brand in the marketplace.

Customer equity focuses on the financial impact of individual customer relationships on a company’s bottom line. Increasing it allows companies to drive revenue growth and profitability.

Brand equity focuses on the long-term impact of brand perception on consumer behaviour. A strong brand can help companies differentiate themselves from competitors and command premium prices in the marketplace.

Managing customer equity involves strategies to attract new customers, retain existing customers and increase customer lifetime value. It can include personalized marketing campaigns, loyalty programs and customer relationship management initiatives.

Managing brand equity involves strategies to enhance brand awareness, build brand loyalty and protect the brand’s reputation. It can include brand-building campaigns, brand partnerships and brand messaging consistency.

Let us go through the proven tactics that can elevate customer equity and empower your brand to build a thriving, loyal community.

One way to boost customer equity in marketing is by developing a relationship marketing strategy. The approach focuses on building long-term, meaningful connections with customers, rather than just focusing on making a quick sale. Always remember that fully engaged customers bring in 37% higher revenue and sales than actively disengaged customers.

A customer reaches out to the company with a question or concern. Instead of being met with automated responses or long wait times, they are greeted by a friendly face via video chat customer service. The personalized touch not only resolves their issue quickly and efficiently but also leaves a lasting positive impression.

Best practices:

Ever thought about how showing the clients that the brand appreciates them can help increase customer equity in marketing? Taking the time to make customers feel appreciated allows the brand to build stronger relationships and increase customers’ lifetime value to the business.

One way to do this is through personalized gestures or interactions that show clients that the brand truly cares about their satisfaction. It could be as simple as sending a thank-you note or offering a discount on their next purchase. Small acts of appreciation can go a long way in building customer loyalty and increasing the overall value of the business.

Best practices:

Offering greater convenience than competitors allows the brand to make life easier for customers and show them that the brand values their time. It can lead to increased customer loyalty and repeat business, ultimately boosting your customer equity in the long run.

Imagine a scenario where a customer is deciding between two companies offering similar products or services. Company A offers quick and efficient customer service through video chat. Company B requires the customer to wait on hold for extended periods of time to speak to a representative. Here the customer is more likely to choose Company A because of the convenience factor.

Best practices:

Customer loyalty programs play a crucial role in increasing customer equity by establishing long-term relationships with the audience. Members of loyalty programs generate 12-18% more incremental revenue growth per year than non-members. Rewarding customers for their continued support and purchases allows the brand to incentivize them to choose your brand over the competitor’s time.

Let’s take an example of a coffee shop offering a loyalty card. The customers can collect stamps for each purchase and receive a free drink after reaching a certain number of visits. The simple program encourages repeat business and keeps customers coming back for more caffeine fixes.

Best practices:

One valuable tip to consider is offering value-driven marketing campaigns. Focusing on providing value to customers through campaigns allows the brand to build stronger relationships, retain loyal customers and ultimately drive higher revenue. Customers are more likely to engage with and make purchases from brands that provide them with meaningful content.

Let’s take an example of a cosmetics company that could offer makeup tutorials and beauty tips as part of their marketing campaigns. Providing value to their customers beyond just selling products. Here are three ways to implement this tip effectively:

Best practices:

Check out the examples of customer equity to understand how leading brands have successfully tapped into this invaluable resource to create sustainable growth.

1. Apple

Apple is a prime example of a brand that places a strong emphasis on customer equity. The tech giant has built a loyal customer base through its innovative products, exceptional customer service and great user experience. Apple has implemented various strategies to enhance equity such as creating a seamless and user-friendly ecosystem of devices.

The impact of Apple’s focus on consumer equity is evident in its high customer retention rates, strong brand loyalty and consistently growing revenue. Prioritizing the customer experience and building strong relationships with its customers allows Apple to maintain its position.

2. Nike

Nike is another brand that has successfully leveraged customer equity to drive business growth. Nike has a strong focus on building emotional connections with its customers through powerful marketing campaigns. Nike has also implemented strategies like the NikePlus membership program. It rewards loyal customers with exclusive benefits and personalized recommendations.

Nike has seen increased customer engagement, higher customer lifetime value and a competitive advantage in the sportswear market. Continually innovating and catering to the needs of its customers allows Nike to maintain its position as a leading global brand.

3. Starbucks

Starbucks is known for its customer-centric approach to business and its focus on building strong relationships with its customers. Starbucks has implemented strategies to enhance customer equity such as personalized marketing campaigns and a commitment to providing exceptional customer service.

The impact of Starbucks’ focus on consumer equity is evident in its high customer satisfaction ratings, strong brand loyalty and consistent growth in revenue. Prioritizing the customer experience allows Starbucks to differentiate itself and build a loyal customer base.

4. Amazon

Amazon is a prime example of a brand that has revolutionized the e-commerce industry by focusing on customer equity. Amazon has implemented strategies like personalized recommendations, fast and efficient delivery services. Amazon also offers benefits like Amazon Prime membership or Amazon Fresh grocery delivery to reward and retain loyal customers.

The impact of Amazon’s focus on consumer equity is evident in its high customer retention rates, strong brand loyalty and consistent revenue growth. Continuously innovating to meet the evolving needs of customers allows Amazon to become a dominant player in the e-commerce market and a trusted brand worldwide.

Leveraging customer equity is crucial for growing the business. Focusing on building strong relationships with customers allows the brand to increase customer loyalty, retention and lifetime value. It leads to higher profitability and sustainable growth for the business.

The key to success lies in understanding customers, meeting their needs and continuously improving products or services. Prioritizing consumer equity allows the brand to ensure long-term success and profitability for the business. Stay customer-focused and watch the business thrive.

Customer equity is the overall value of a customer, taking into account their current and potential future purchases. Customer lifetime value calculates the total revenue a customer will bring over their lifespan as a customer. Consumer equity focuses on the holistic value of a customer, customer lifetime value is a more specific and quantifiable metric.

Share of customer refers to the percentage of a customer’s total spending in a product category that a company captures. Customer equity is the total combined lifetime value of all the company’s current and potential customers. The share of customers focuses on individual customer spending, consumer equity looks at the overall value of all customers to the company.

Social media marketing activities can greatly enhance customer equity by increasing brand awareness, improving customer engagement and building brand loyalty. Creating meaningful connections with customers through social media platforms allows companies to improve customer satisfaction. It leads to long-term relationships and ultimately higher customer lifetime value. Social media marketing is a powerful tool for maximizing consumer equity.

A company can increase its customer equity by focusing on building strong relationships with existing customers. It can be done by providing exceptional customer service, offering personalized experiences and implementing loyalty programs. Continuously engaging with customers, understanding their needs and delivering value allows a company to increase customer loyalty. It ultimately adds their lifetime value to the business.

Businesses can measure equity through various key performance indicators such as customer lifetime value, customer satisfaction scores and net promoter scores. Tracking and analyzing these metrics allows businesses to gain insights into the value of their customers. It helps to make strategic decisions to increase consumer equity.

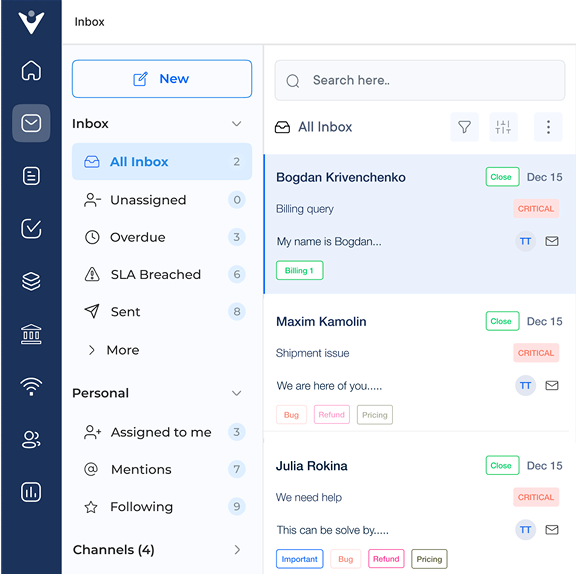

Market better, sell faster and support smarter with Veemo’s Conversation Customer Engagement suite of products.

Unify all your customer data in one platform to deliver contextual responses. Get a 360 degree view of the customer lifecycle without switching tools.

Connect with the tools you love to reduce manual activities and sync your business workflows for a seamless experience.

https://veemo.io/wp-content/uploads/2025/12/customer-connection.png

1256

2400

Indrasish Singha

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

Indrasish Singha2026-02-06 09:11:372026-01-19 09:14:05What is Customer Connection: Mistakes, Metrics & Examples

https://veemo.io/wp-content/uploads/2025/12/customer-connection.png

1256

2400

Indrasish Singha

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

Indrasish Singha2026-02-06 09:11:372026-01-19 09:14:05What is Customer Connection: Mistakes, Metrics & Examples https://veemo.io/wp-content/uploads/2025/12/complaint-management.png

1256

2400

Indrasish Singha

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

Indrasish Singha2026-02-03 09:04:022026-01-19 09:10:02What is Complaint Management? Importance, Key Steps & Strategies

https://veemo.io/wp-content/uploads/2025/12/complaint-management.png

1256

2400

Indrasish Singha

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

Indrasish Singha2026-02-03 09:04:022026-01-19 09:10:02What is Complaint Management? Importance, Key Steps & Strategies https://veemo.io/wp-content/uploads/2025/12/AI-Self-Service.png

1256

2400

Indrasish Singha

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

Indrasish Singha2026-01-26 09:52:482026-01-13 10:17:07What is AI Self Service? Benefits, Key Metrics and Best Practices

https://veemo.io/wp-content/uploads/2025/12/AI-Self-Service.png

1256

2400

Indrasish Singha

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

Indrasish Singha2026-01-26 09:52:482026-01-13 10:17:07What is AI Self Service? Benefits, Key Metrics and Best PracticesGrow Customer Relationships and stronger team collaboration with our range of products across the Conversational Engagement Suite.

Chatbot Vs Live Chat: The Key Differences

Scroll to top

Chatbot Vs Live Chat: The Key Differences

Scroll to top