What is Customer Service Banking? A Comprehensive Guide

Banking customers expect more than just transactions. It plays a vital role in building trust, enhancing satisfaction and creating long-lasting relationships with clients.

Banking customers expect more than just transactions. It plays a vital role in building trust, enhancing satisfaction and creating long-lasting relationships with clients.

Customer expectations have undergone a significant transformation. Traditional banking models have found it challenging to adapt to the evolving demands of contemporary customers. Customers yearn for personalized and proactive support that anticipates their evolving needs, yet many banks have failed to provide outstanding service. An overwhelming 91% of customers emphasize the importance of quality customer service when selecting a bank.

Introducing customer service banking, a transformative solution that addresses the challenges head-on. The innovative approach transforms the banking experience by prioritizing the customer in every interaction. Customer care in banking transforms customers’ perceptions of their financial institutions with personalized attention. Embracing the customer-centric model can help banks bridge the gap between customer expectations and reality.

Customer service in banking refers to the assistance and support provided by financial institutions to their clients about their banking offerings. It includes the entire experience customers have with the bank, from opening an account to addressing inquiries.

The key elements:

Let us explore how outstanding customer service is fundamental to success in the banking industry.

1. Customer retention and loyalty: A study by Accenture shows that 52% of customers switch banks due to poor service. A report from Capgemini indicates that banks prioritizing customer service achieve customer retention rates of up to 93%. Banks can strengthen long-lasting relationships with their customers by providing exceptional service.

2. Reputation and word-of-mouth: A bank’s reputation can be influenced by customer experiences shared on the internet. A survey by American Express found that 59% of customers would try a new brand or company after reading positive reviews. A negative experience can rapidly circulate on social media and review platforms, harming a bank’s reputation.

3. Revenue growth and cross-selling: Satisfied customers are more inclined to consider other products and services provided by their bank. A Bain & Company study shows that a 5% increase in customer retention can lead to a 25% to 95% increase in profits. Delivering exceptional service can enable banks to recognize cross-selling opportunities and boost their revenue streams.

4. Compliance and risk management: The banking industry is highly regulated and noncompliance with regulations can lead to significant consequences. A study by Deloitte revealed that 83% of financial institutions believe customer service is essential for managing compliance risks. Well-trained customer service representatives can help banks comply with regulations, reduce risks and uphold a strong reputation.

5. Cost savings: Ineffective customer service can result in increased costs for banks. A report by Forrester Research shows that it costs businesses $22 to handle a service issue call, compared to just $2 for a self-service transaction. Banks can cut operational costs and boost efficiency by implementing effective customer service strategies. It may involve self-service portals and knowledgeable representatives.

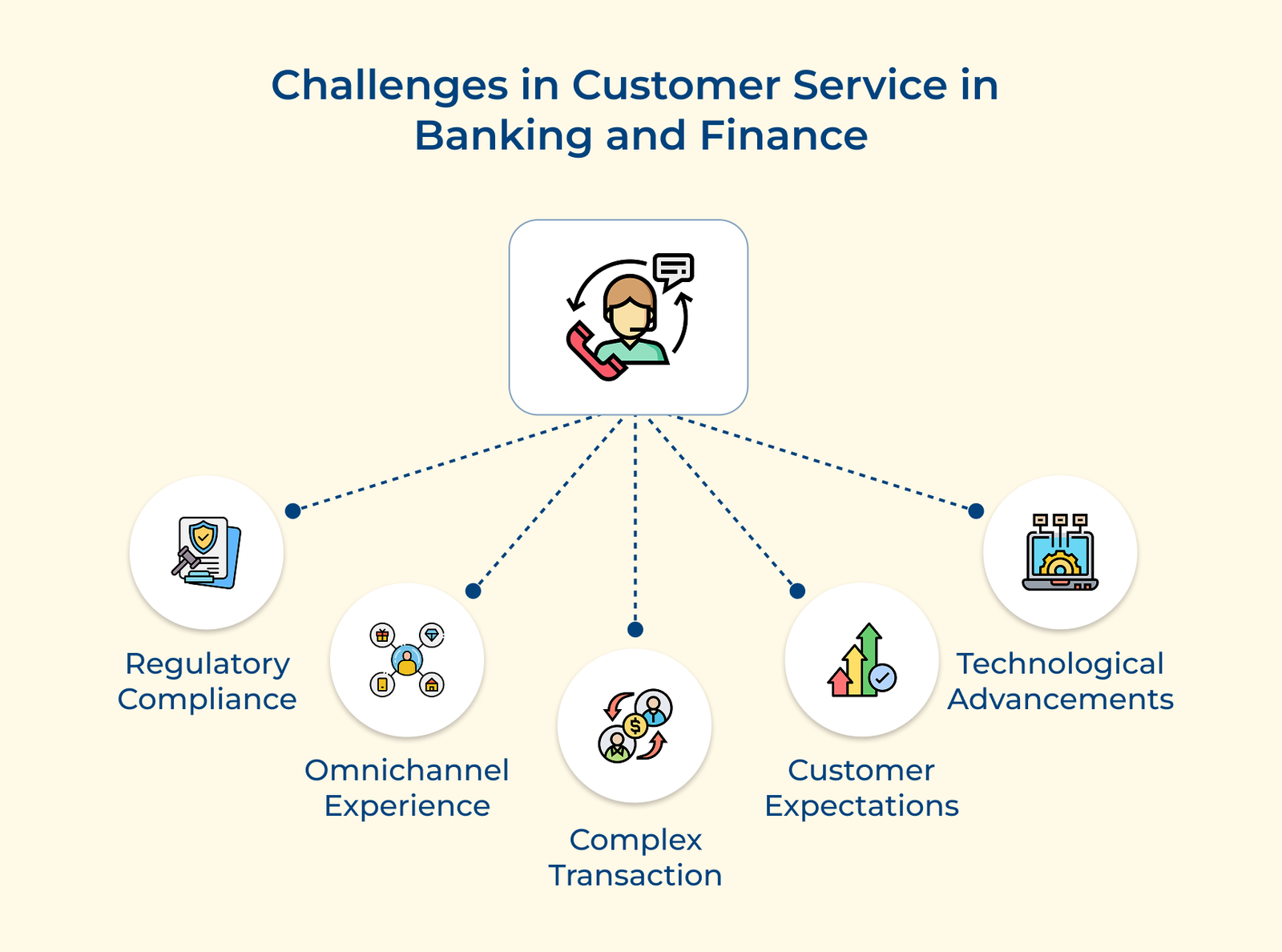

Examine the key challenges encountered by financial institutions and learn effective strategies to address them.

The banking industry is governed by strict regulations and data privacy laws. Customer service representatives must navigate complex compliance requirements. Noncompliance with regulations can lead to serious repercussions, including legal penalties and harm to reputation. Striking a careful balance between delivering personalized service and safeguarding sensitive customer information is a continual challenge.

More than 80% of customers expect consistent interactions across departments and channels, most prominently in digital spaces. Maintaining consistency in service quality and real-time data synchronization across channels poses a substantial challenge. Banks need to invest in a strong technological infrastructure and integrate their systems to provide a seamless customer experience across all touchpoints.

The banking industry deals with intricate products, services and transactions. Customer service representatives should have extensive knowledge to effectively handle complex inquiries. It can be related to investments, loans, mortgages and other financial instruments. Delivering clear information to customers with different levels of financial literacy can be a challenging task.

Customer expectations have significantly increased in the wake of digital disruption and the desire for instant gratification. Customers demand prompt responses, personalized attention and immediate resolution of their issues. Banks must find a balance between fulfilling high expectations and ensuring operational efficiency, all while maintaining service quality.

The swift evolution of technology offers both opportunities and challenges for customer service in the banking sector. Digital innovations such as chatbots, artificial intelligence and robotic process automation can improve service delivery. They also require significant investments and careful integration with existing systems. Keeping pace with advancements and integrating them into operations presents a challenge.

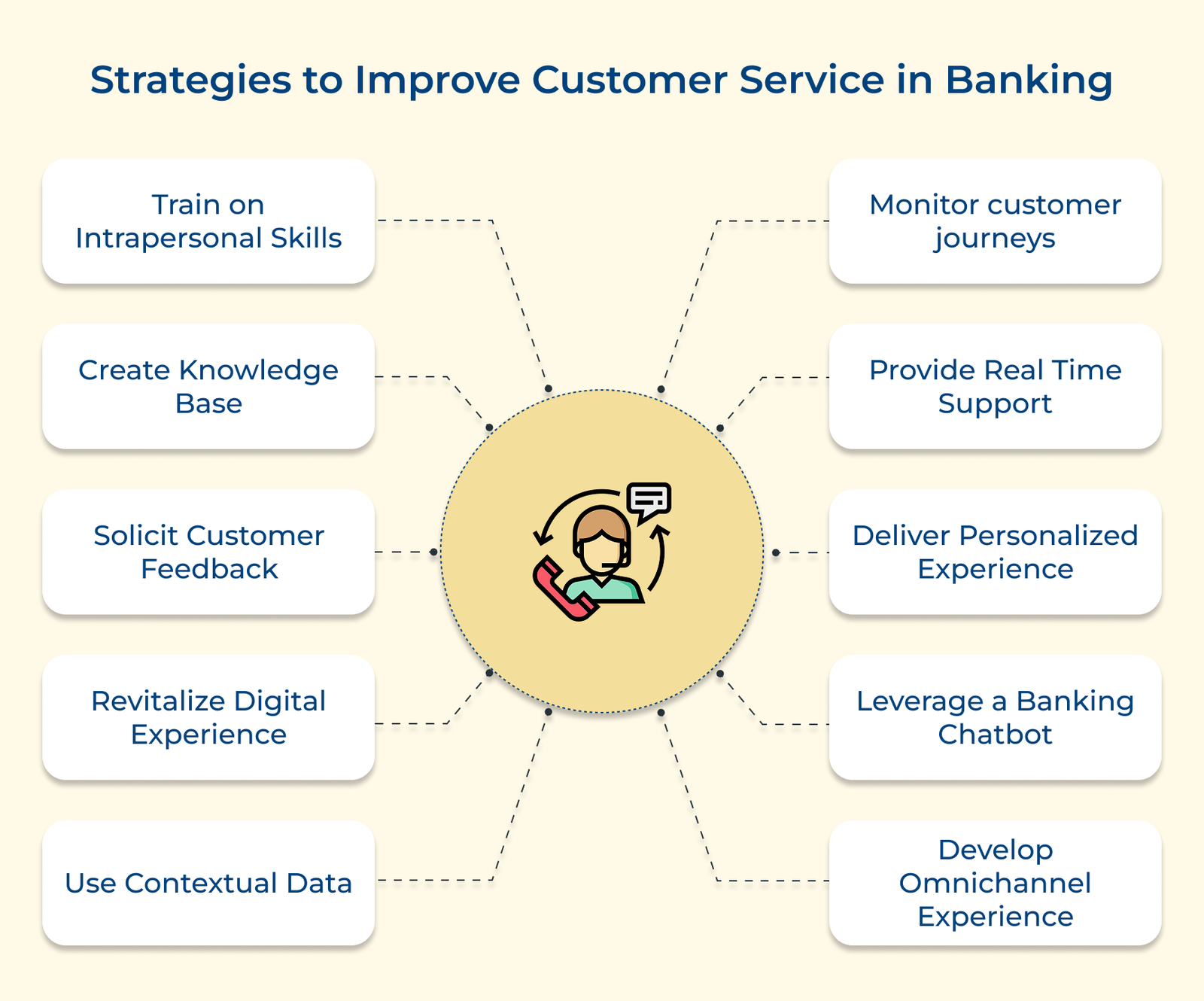

Let’s explore the key customer service banking strategies to help you enhance customer service in the banking industry.

Tracking end-to-end customer journeys and developing a 360-degree view is a strong strategy for enhancing customer service in the banking sector. The approach involves tracking and analyzing every touchpoint a customer has with the bank across multiple channels. Achieving a thorough understanding of customer journeys can assist banks in pinpointing pain points. The strategy helps in enhancing customer service in several ways:

1. Personalization: Banks can customize their services to align with individual customer needs, preferences and behavior patterns with a 360-degree view. It leads to more personalized and relevant experiences.

2. Proactive support: Banks can anticipate potential issues and proactively address them by analyzing customer journeys, reducing customer frustration.

Pro tips:

Customers expect prompt assistance and quick resolutions to their queries or issues. That’s where real-time support comes into play. An effective method for providing real-time support is via live chat. Imagine you’re trying to transfer funds or check the account balance and you hit a roadblock. Live chat allows you to quickly connect with a customer service representative. They can guide you through the process or resolve your issue on the spot. No more waiting on hold or scheduling appointments!

Live chat is especially beneficial for situations such as account inquiries, navigating online banking platforms or handling time-sensitive issues. It’s like having a virtual assistant readily available to help you out.

What it does:

A significant 70% of consumers expect personalized advice from their banks, reflecting the fact that gone are the days of one-size-fits-all solutions. Providing personalized service can be pivotal for banks to forge stronger relationships with their customers and differentiate themselves from the competition. One effective way to achieve it is through video chat.

Imagine having the opportunity to engage in a face-to-face conversation with a bank representative from the comfort of your home or office. Video chat is especially advantageous for situations such as opening new accounts, applying for loans or seeking investment guidance. It allows bank representatives to better understand the unique needs and provide personalized offers based on the specific circumstances.

Key benefits:

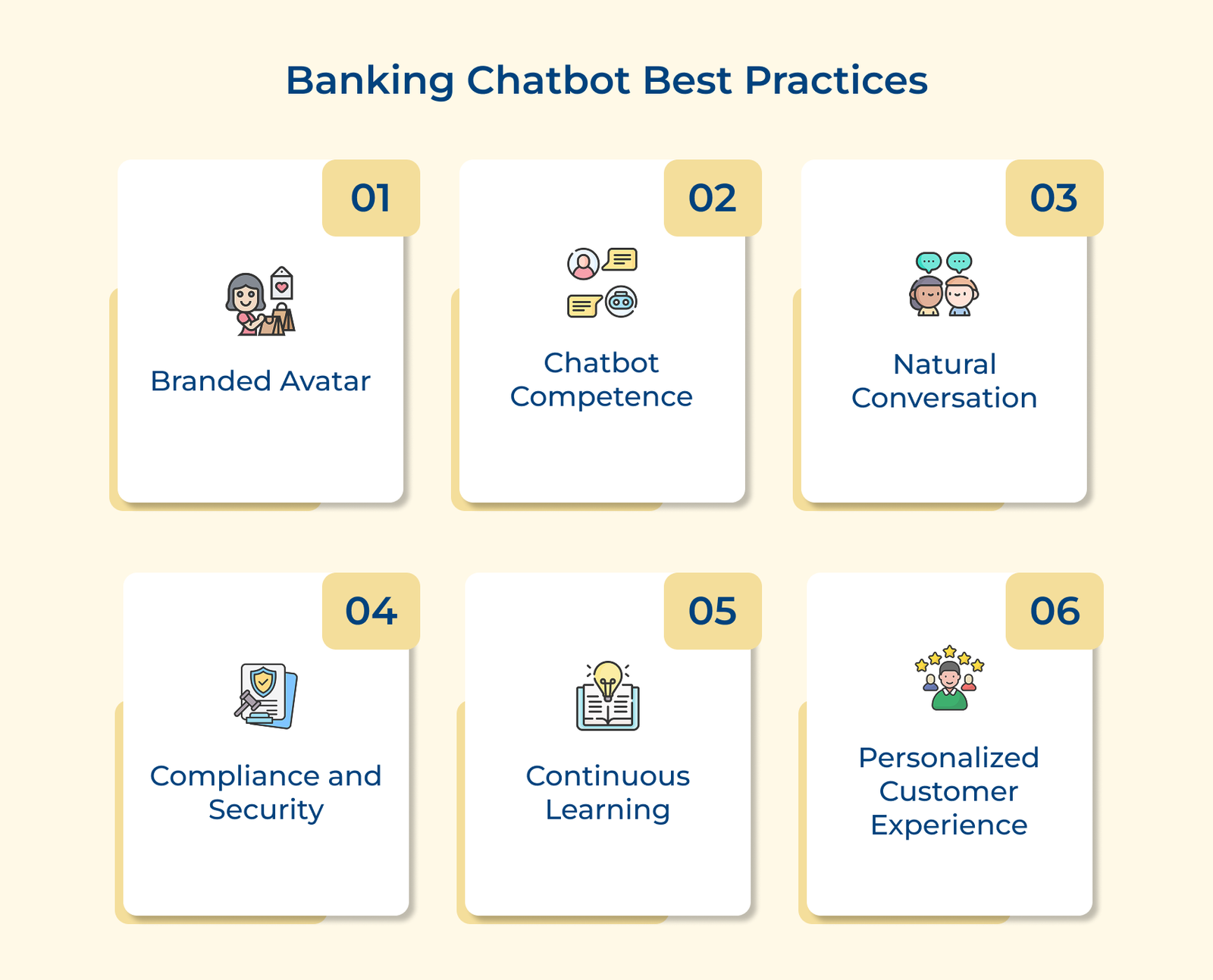

Leveraging AI-powered chatbots is a fantastic strategy for banks to improve their customer service game. While both chatbots and live chat provide real-time assistance, chatbots offer distinct advantages.

One key difference is that chatbots can handle a massive volume of simultaneous conversations without compromising on response times. They’re available 24/7, tireless virtual assistants ready to serve customers at any hour. Customers can get their basic needs addressed instantly, without having to navigate complicated phone menus. Beyond simple queries, chatbots also handle more complex tasks, such as providing product information and assisting with loan and credit card applications.

The importance:

Customers expect a seamless and consistent experience, even if they’re visiting a branch or chatting with a representative online. Banks can improve customer service in multiple ways by implementing an omnichannel strategy. It provides a seamless experience for customers, regardless of how they choose to engage with the bank.

Imagine initiating a transaction on the mobile app and then smoothly continuing or finishing it at a physical branch, without having to re-enter any information. The strategy is particularly useful for complex banking processes like applying for a loan or opening a new account. Customers can start the process online, submit the required documents and then complete it in person with a representative. No more starting from scratch or repeating the same information multiple times!

Pro tips:

Investing in training that emphasizes intrapersonal skills can enable banks to equip their representatives with the tools necessary to enhance stronger connections with customers. We’re talking about skills like active listening, emotional intelligence and communication.

Imagine entering a bank branch or calling customer service and being welcomed by a representative who communicates clearly. That kind of personal touch can turn a potentially frustrating experience into a positive one. The strategy is especially crucial when handling sensitive financial issues or responding to customer complaints. Having strong intrapersonal skills allows representatives to approach situations with tact and discover agreeable solutions.

Pro tips:

Creating a robust knowledge base for self-help is a brilliant strategy that banks can leverage to improve their customer service game. Customers typically prefer to seek solutions independently before contacting a representative. Imagine having a comprehensive online library of articles, tutorials and FAQs covering a wide range of topics related to banking processes. Customers can quickly find the information they need with just a few clicks or taps.

Let us see an example. Say you’re trying to figure out how to dispute a transaction on the credit card statement. Instead of calling customer service, you can easily search the knowledge base and resolve the issue on your own.

What it does:

Soliciting customer feedback is an absolute game-changer when it comes to improving customer service in the banking industry. Think about it – who better to provide insights and suggestions than the customers themselves? They’re the ones interacting with the services or experiencing the ups and downs firsthand. Actively pursuing customer feedback can provide banks with valuable insights into what is functioning effectively and which areas require improvement.

Let me give you an example. Say a bank notices a spike in negative feedback about their mobile app’s user interface. They can prioritize updating the app’s design to enhance its intuitiveness and user-friendliness which helps in improving customer satisfaction.

How to collect feedback

Customers expect seamless digital interactions, even when they’re using a mobile app, online banking portal or the bank’s website. Investing in revamping their digital channels enables banks to not only meet but also exceed customer expectations. Picture effortlessly navigating online banking, swiftly locating the information you need and completing transactions with just a few taps or clicks. Now that’s what we call excellent customer service!

Consider a scenario where a bank enhances its mobile app with a stylish new design, intuitive navigation and personalized features like customized financial advice. Customers are going to love the convenience, which makes it easier for them to manage their finances on the go.

Best practices:

Using contextual data is a game-changer when it comes to improving customer service in the banking industry. Envision delivers customized experiences that cater to each customer’s specific situation and preferences. That’s the power of contextual data! Leveraging the wealth of information they have about customers allows banks to gain valuable insights and provide more relevant services.

Let’s consider that a customer frequently transfers money from their checking account to a savings account each month. The bank could proactively send a reminder or provide a simplified process for making that recurring transfer using contextual data. It helps in saving the customer time and effort.

Pro tips:

Each banking institution mentioned below showcases its commitment to customer satisfaction and loyalty. Here are 4 customer service banking examples:

1. Navy Federal Credit Union

Navy Federal Credit Union is recognized for its commitment to personalized service and member satisfaction. One way they achieve good customer service is by having service representatives who are trained to address member inquiries promptly. The representatives are knowledgeable about the offerings offered by the credit union.

Navy Federal Credit Union’s focus on personalized service enhances a strong connection between the credit union and its members. The approach helps in retaining existing members and attracts new members who are looking for a bank that prioritizes their needs.

2. BOK Financial

BOK Financial is recognized for its proactive communication and accessibility to customers. They have established multiple communication channels, such as online chat, social media and a customer service helpline available 24/7.

Their banks being readily available and highly responsive helps them deliver a seamless experience that reassures customers and makes banking simpler. They have also optimized their communication processes and equipped their customer service representatives with the tools needed to promptly address customer concerns.

3. Amarillo National Bank

Amarillo National Bank stands out for its community-oriented approach to customer service. They have deep roots in the local community and are committed to supporting local businesses. Amarillo National Bank supports community events, participates in local organizations, and offers financial literacy programs to educate its customers.

The community-focused approach to customer service sets them apart from other banks. Amarillo National Bank’s dedication to the community enhances a sense of connection and trust among its customers. Supporting local initiatives and actively engaging with the community demonstrates to customers that they prioritize more than just banking transactions.

Check out the top customer service tools that are revolutionizing the way companies in the banking industry interact with their customers.

Best customer service banking tool to increase customer satisfaction

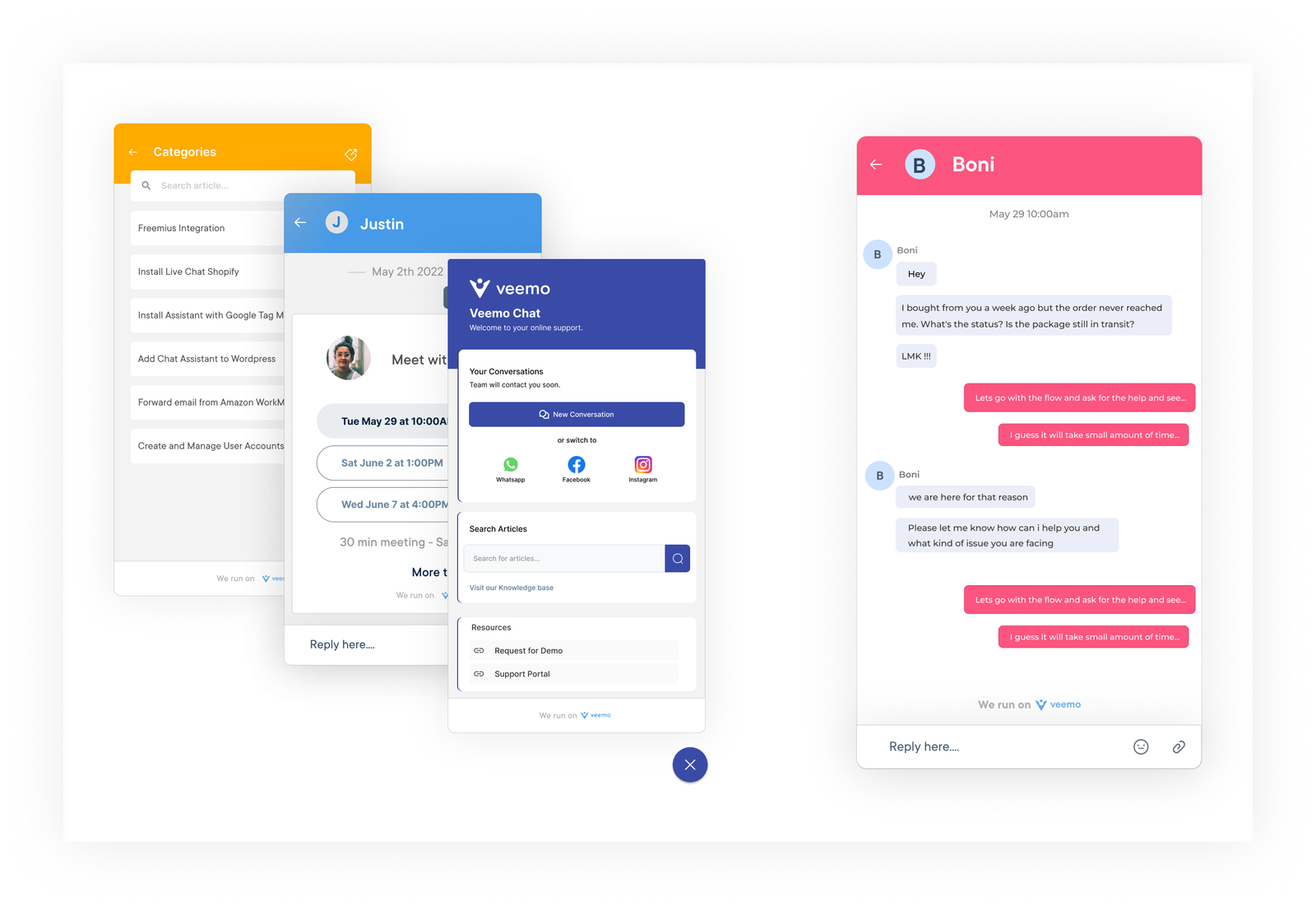

Veemo is a cutting-edge customer service tool designed specifically for banking and finance companies, enabling them to provide exceptional customer experiences. The platform includes numerous features designed to enhance communication and boost customer satisfaction. It empowers businesses to manage customer interactions seamlessly. Veemo also offers agents tailored and efficient support across various channels.

Key Features:

Pricing: There are four different plans ranging from $29 to $129. Visit Veemo’s pricing page for more insights.

Top customer service banking software for omnichannel banking

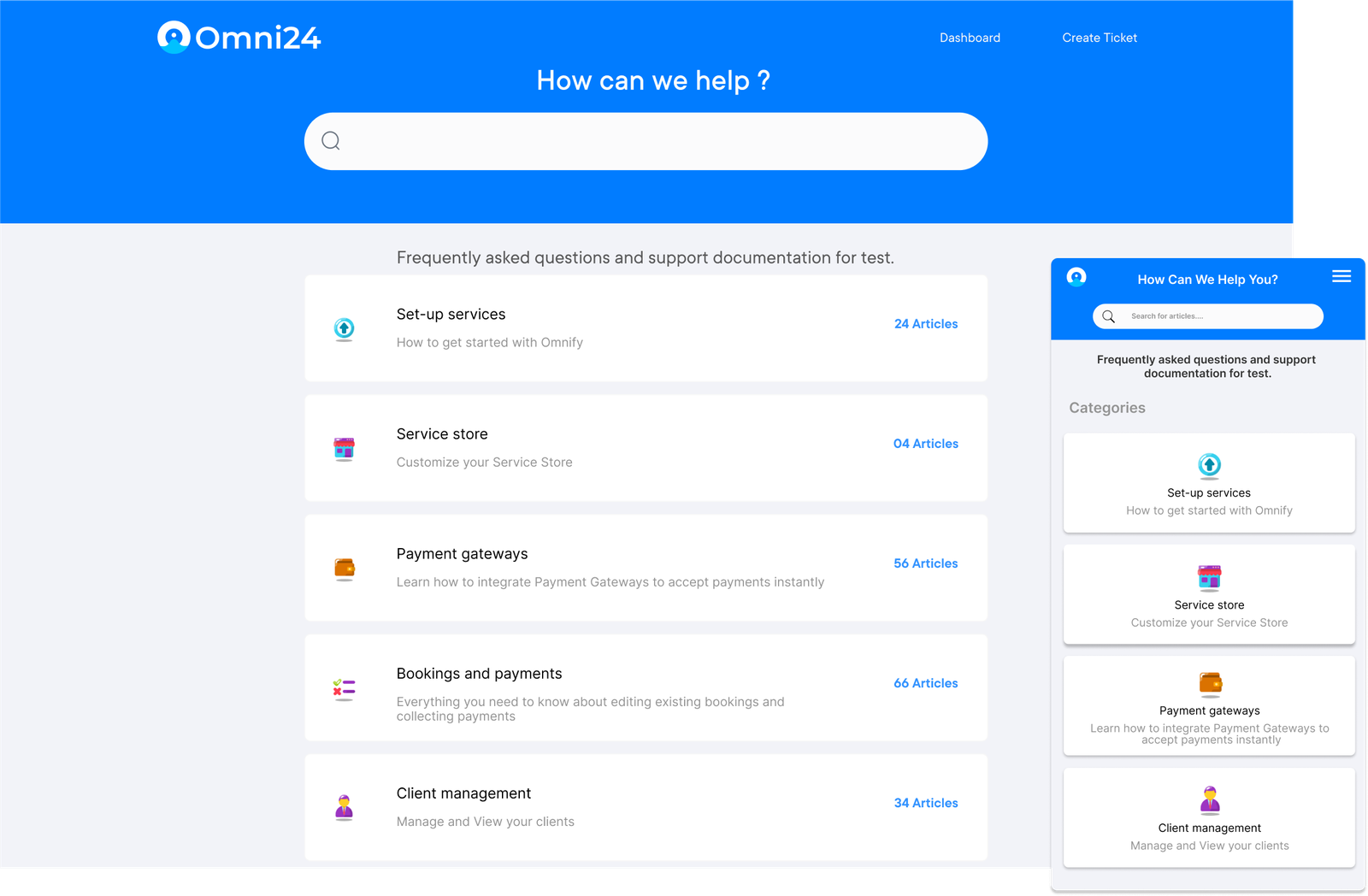

Omni24 provides a complete set of customer service tools designed specifically for the banking and finance sectors. Omni24 provides a seamless customer service experience for both agents and customers.

Key features:

Pricing: The pricing starts from $29/month with one inbox feature and goes up to $149/month for unlimited inboxes. Check out their pricing page for detailed information.

Customer service is a crucial aspect of maintaining customer satisfaction, especially in the banking and finance industry. Customers now expect swift resolutions to their inquiries with the growth of digital banking and online transactions. Banking and finance companies are leveraging customer service tools to simplify their support processes.

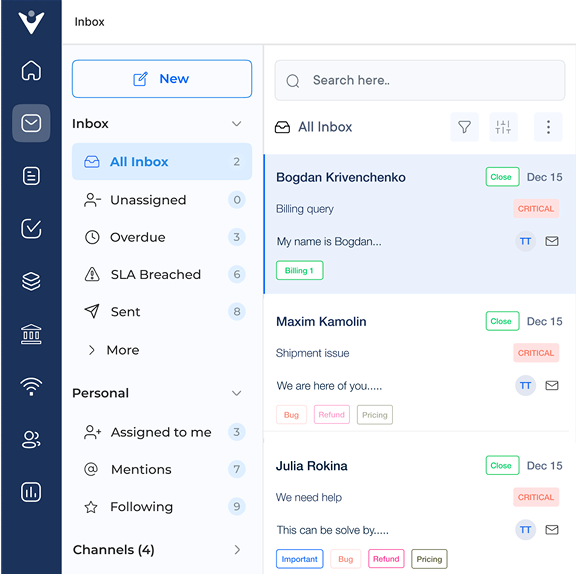

Hiver is a customer service tool that integrates seamlessly with Gmail, allowing teams to collaborate on customer emails without leaving their inbox. Hiver enables teams to respond more quickly to inquiries through features like shared inboxes and email templates.

HubSpot Service Hub is an all-in-one customer service platform that provides tools for ticketing, live chat, a knowledge base and additional features. Banking companies can use HubSpot Service Hub to track customer interactions and analyze customer feedback.

Traditional banking alone no longer meets evolving customer expectations. The necessity for superior service stems from the increasing demand for personalized attention, immediate resolution and seamless experiences across all touchpoints.

Customer service banking has revolutionized the banking experience by offering dedicated relationship managers, 24/7 support channels and tailored financial solutions. The approach transforms routine transactions into meaningful interactions, helping customers make informed decisions while feeling valued and supported.

Banks can now establish lasting relationships with their clients through proactive assistance, simplified processes and enhanced communication. It not only improves customer satisfaction and retention but also drives business growth through positive word-of-mouth.

Customer service in the banking sector is often criticized for long wait times, lack of personalized service and complicated processes. Customers find it challenging to navigate complicated regulations and fees, often encountering impersonal interactions along the way. Online banking often misses the personal connection and in-person support. There is a need for improved communication, transparency and efficiency in the industry.

Banks offer three main customer services: 1) Personal banking, which includes savings accounts, loans and credit cards for individual customers. 2) Business banking offers services like business accounts, loans and merchant solutions for companies. 3) Investment services include wealth management and retirement planning for customers seeking to enhance their financial growth.

Businesses need excellent communication skills to interact with customers effectively. Problem-solving skills are essential for resolving customer issues efficiently. Technical skills are essential for navigating banking systems and applications effectively. Attention to detail is important for accuracy in transactions. A deep sense of empathy and patience is essential for addressing customer inquiries.

Customer service in banking consists of supporting customers with their financial requirements. It can range from helping customers open accounts or answering questions about banking offerings. Representatives receive training to deliver outstanding service and guarantee customer satisfaction while complying with banking regulations.

Customers are becoming more worried about the safety of their personal information during banking transactions. Banks should communicate the security measures they have implemented to protect customer data, such as encryption, to reassure customers about the safety of their accounts.

Market better, sell faster and support smarter with Veemo’s Conversation Customer Engagement suite of products.

Unify all your customer data in one platform to deliver contextual responses. Get a 360 degree view of the customer lifecycle without switching tools.

Connect with the tools you love to reduce manual activities and sync your business workflows for a seamless experience.

https://veemo.io/wp-content/uploads/2025/12/customer-connection.png

1256

2400

indrasish5342@gmail.com

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

indrasish5342@gmail.com2026-02-06 09:11:372026-01-19 09:14:05What is Customer Connection: Mistakes, Metrics & Examples

https://veemo.io/wp-content/uploads/2025/12/customer-connection.png

1256

2400

indrasish5342@gmail.com

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

indrasish5342@gmail.com2026-02-06 09:11:372026-01-19 09:14:05What is Customer Connection: Mistakes, Metrics & Examples https://veemo.io/wp-content/uploads/2025/12/complaint-management.png

1256

2400

indrasish5342@gmail.com

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

indrasish5342@gmail.com2026-02-03 09:04:022026-01-19 09:10:02What is Complaint Management? Importance, Key Steps & Strategies

https://veemo.io/wp-content/uploads/2025/12/complaint-management.png

1256

2400

indrasish5342@gmail.com

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

indrasish5342@gmail.com2026-02-03 09:04:022026-01-19 09:10:02What is Complaint Management? Importance, Key Steps & Strategies https://veemo.io/wp-content/uploads/2025/12/AI-Self-Service.png

1256

2400

indrasish5342@gmail.com

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

indrasish5342@gmail.com2026-01-26 09:52:482026-01-13 10:17:07What is AI Self Service? Benefits, Key Metrics and Best Practices

https://veemo.io/wp-content/uploads/2025/12/AI-Self-Service.png

1256

2400

indrasish5342@gmail.com

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

indrasish5342@gmail.com2026-01-26 09:52:482026-01-13 10:17:07What is AI Self Service? Benefits, Key Metrics and Best PracticesGrow Customer Relationships and stronger team collaboration with our range of products across the Conversational Engagement Suite.

What is Customer Experience Optimization? 8 Actionable Tips

Scroll to top

What is Customer Experience Optimization? 8 Actionable Tips

Scroll to top