Average Customer Retention Rate by Industry in 2026

Learn about the average customer retention rates by industry, why they vary and what businesses can do to improve retention. Compare benchmarks and discover strategies to build long-term loyalty.

Learn about the average customer retention rates by industry, why they vary and what businesses can do to improve retention. Compare benchmarks and discover strategies to build long-term loyalty.

Customer retention is more than just a metric, but the foundation of long-term business success. 60% of companies that prioritize retention are more profitable. Yet, many companies struggle to keep customers engaged amid shifting expectations and growing competition. The challenge lies in the rapidly evolving customer expectations and increasing competition, which makes maintaining strong customer relationships more complex than ever.

Traditional retention tactics are losing their edge and businesses that fail to adapt risk falling behind. The key to staying ahead lies in understanding the average customer retention rate by industry and learning from companies that are redefining customer loyalty. Businesses can craft smarter, data-driven strategies that not only retain customers but also strengthen relationships for the future by analyzing what works across different sectors.

The average customer retention rate refers to a vital metric that measures how well a business keeps its customers over time, offering a clear picture of long-term loyalty. Instead of constantly chasing new customers, a strong retention strategy focuses on maintaining and strengthening existing relationships.

The process begins by tracking how many customers stick around over a given period, be it through repeat purchases, subscription renewals, or ongoing engagement, while filtering out new acquisitions. The metric reveals how well your business enhances loyalty and lasting connections.

Key principles:

Understanding the importance of customer retention rates helps organizations develop strategies. Let’s go through why the customer retention rate is crucial for business success.

1. Cost-effective growth strategy

Keeping existing customers is far more cost-effective than constantly chasing new ones, often costing five times less. Retaining customers costs 5x less than acquiring new ones. Since they already know and trust your brand, maintaining their loyalty requires fewer resources while delivering greater returns.

2. Increased customer lifetime value

A high retention rate means customers stick around longer, giving them more chances to buy again. Over time, their spending increases, creating more opportunities for cross-sells and upsells, driving higher revenue per customer.

3. Enhanced market intelligence

Loyal customers offer valuable insights through their feedback and buying habits. Their continued engagement reveals shifting preferences and market trends. It helps you refine your products and stay ahead of the competition.

4. Stronger brand advocacy

Happy, long-term customers naturally promote your brand by sharing their experiences with friends and family. Their genuine recommendations build trust, attracting new customers without the high costs of traditional advertising.

5. Predictable revenue streams

Loyal customers create a steady revenue stream, making it easier to forecast finances and plan growth. Financial stability allows you to invest confidently in new products, services and expansion.

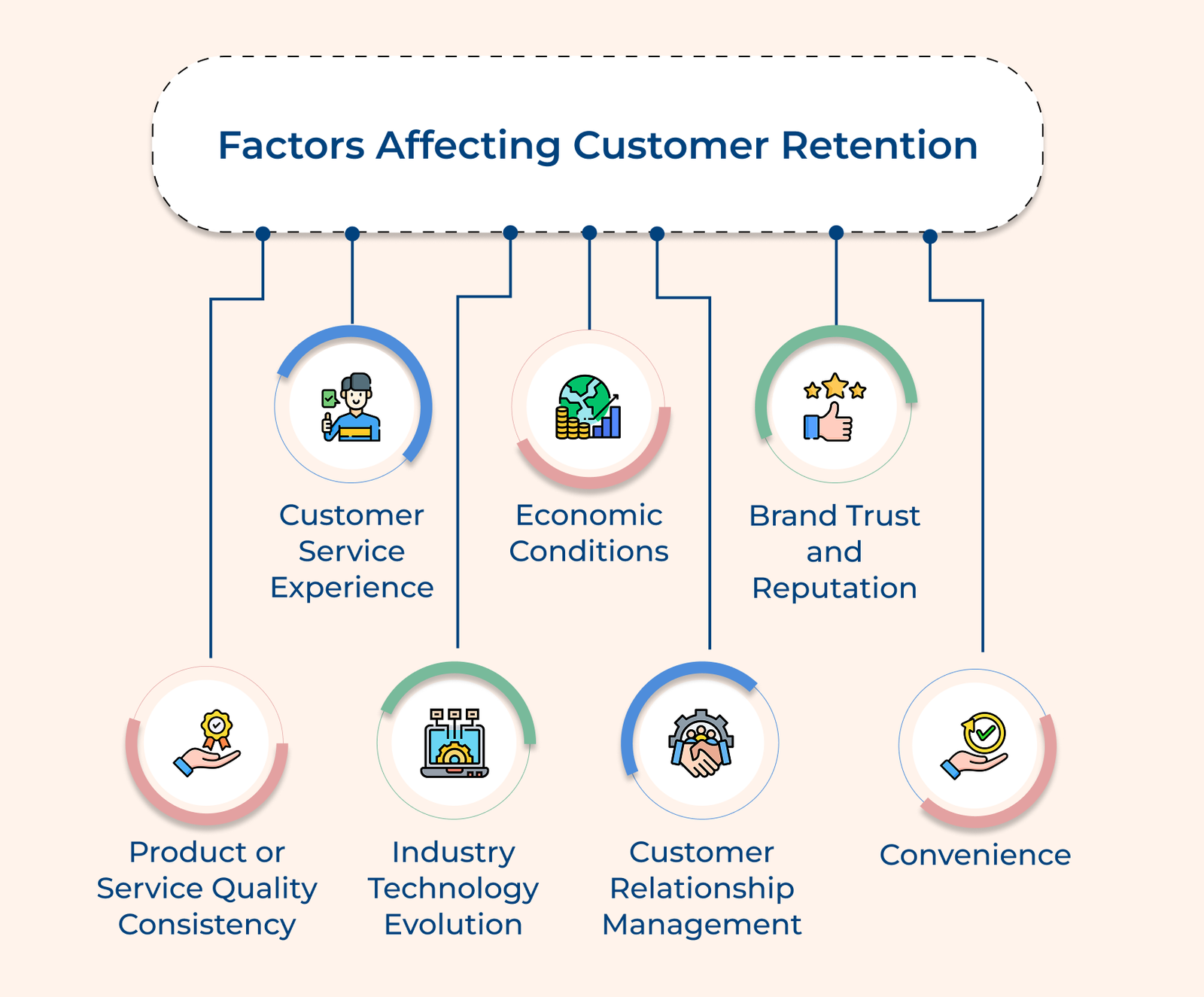

Check out the key factors that influence customer retention strategies, from service quality to pricing and brand trust.

Customer retention starts with delivering a consistently high-quality product or service. When customers rely on the same level of excellence every time, they build trust in your brand. Inconsistent quality creates uncertainty, making customers question if they’re getting the value they expect, often leading them to look elsewhere.

The support you provide plays a crucial role in shaping customer loyalty. Every interaction, be it resolving an issue or answering a simple question, either builds trust or erodes it. Responsive, helpful and genuinely empathetic service makes customers feel valued, reinforcing their decision to stay with your brand.

Customer expectations evolve just as quickly. Businesses must adapt by integrating new technologies without compromising service quality. Staying ahead of innovation ensures customers see your brand as a reliable, forward-thinking choice rather than seeking alternatives that better meet their needs.

Economic shifts directly influence customer spending habits and brand loyalty. In downturns, price sensitivity rises, prompting customers to reassess their choices. Businesses that adjust their value proposition to meet evolving financial realities are more likely to retain customers, even in uncertain times.

Your ability to track and respond to customer needs directly needs retention. A well-implemented CRM system helps you anticipate issues, personalize interactions and strengthen relationships, making customers feel valued.

Your brand’s reputation plays a crucial role in customer loyalty. Consistent positive experiences and transparent business practices build trust, while strong reputation management helps maintain long-term relationships even during challenging times.

How easy it is to do business with you directly affects customer retention. Convenient access, smooth transactions and time-saving features like one-click ordering or automated reordering keep customers engaged.

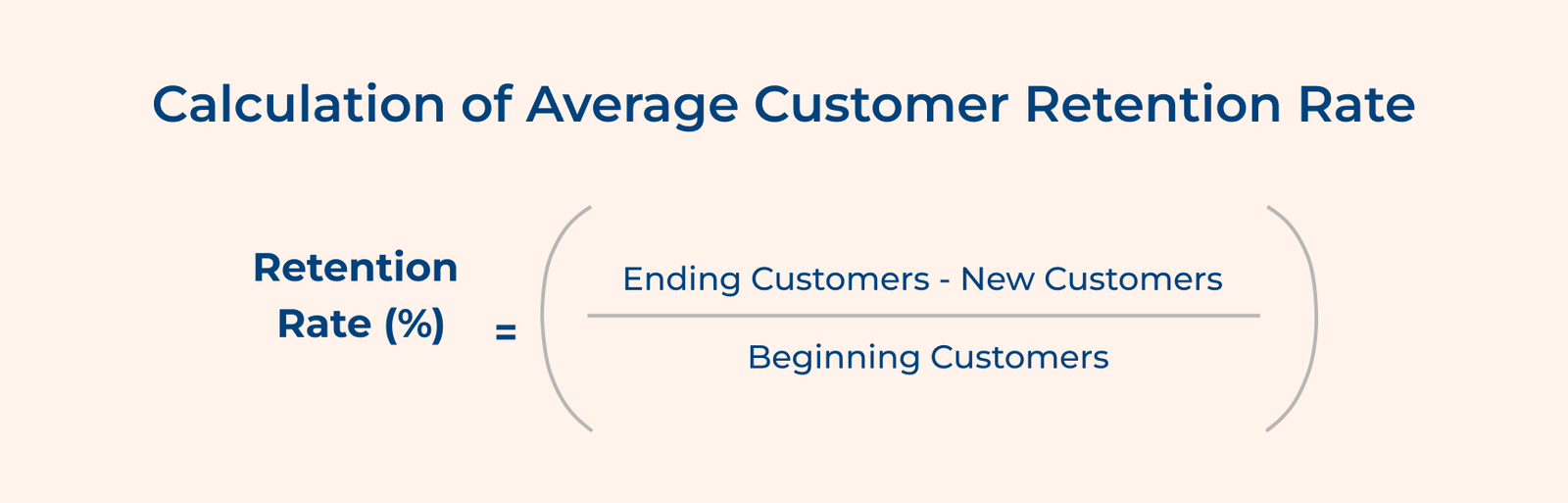

Check out the simple steps to calculate the average customer retention rates. Understanding the metric helps you measure loyalty and refine strategies for long-term relationships.

Customer Retention Rate = ((E – N) / S) × 100

Retention rates vary widely by industry. Generally, a rate above 85% is excellent. Software and SaaS companies often aim for 90% or higher, while a 65% retention rate can be strong in retail. Service-based industries typically fall between 70% and 80%. What’s considered “good” depends on the business model, customer expectations and competition.

1. Choose a time frame

Decide on a specific period— monthly, quarterly or annually. Pick a timeframe that aligns with your business cycles so the data reflects real trends. Consider factors like sales cycles and how often customers typically return.

2. Count starting customers

Count how many active customers you had at the beginning of your chosen period. Be clear about what qualifies as an “active” customer and document this number carefully—it’s the foundation of your calculation.

3. Track new customers

Keep a separate count of new customers acquired during the period. Since retention measures returning customers, separating new sign-ups prevents skewed results.

4. Count ending customers

Count your total customers at the end of the period. It includes both retained customers and new ones. It gives you the raw data before making adjustments.

5. Apply the formula

Plug your numbers into the retention rate formula.

Retention Rate=(Starting Customers Ending Customers−New Customers)×100

Double-check your numbers to avoid miscalculations and get an accurate retention rate.

Let’s calculate the retention rate for a business over one quarter:

– Starting Customers (S) = 1,000

– Ending Customers (E) = 950

– New Customers (N) = 100

Customer Retention Rate = ((950 – 100) / 1,000) × 100

= (850 / 1,000) × 100

= 0.85 × 100

= 85%

The 85% retention rate indicates that the business maintained relationships with 85% of its original customers during the quarter, which falls within the healthy range for most industries.

Let’s go through the average retention rates across various sectors, highlight what constitutes a healthy retention rate and offer actionable tips to enhance your relationships.

E-commerce retention measures how well online retailers keep customers coming back. Shoppers can switch to competitors with just a click, making retention a key metric. Most e-commerce businesses aim for around 35% retention, while the average sits at 28%. Seasonal trends also play a role.

Holiday shopping spikes engagement, but those extra sales don’t always lead to long-term loyalty. Retention often depends on the first purchase, with fast delivery, good product quality and strong post-purchase support all making a lasting impression.

Pro tips:

Healthcare retention tracks how well medical practices keep patients returning for ongoing care. Strong retention ensures continuity of care and better health outcomes. 77% of patients stay with a provider on average, while top-performing practices reach 80% or more.

Some specialists, like chronic care management, see even higher retention rates due to long-term treatment plans. The more positive interactions a patient has, the stronger the relationship becomes. Consistent communication and quality care are key to maintaining trust.

Actionable tips:

SaaS retention metrics show how well a company keeps its users over time. Long-term relationships are everything in a subscription-based model. SaaS companies, on average, hold on to about 85% of their customers, while top performers push that closer to 95%.

Enterprise software tends to have higher retention rates due to deeper integration with client operations. The first 90 days are critical across the board. If users don’t get value early, they’re more likely to leave. Companies that drive strong adoption in the first month usually see better retention and lower churn down the line.

Best practices:

Automotive retention tracking shows how well a dealership or brand keeps customers coming back, for both vehicle purchases and service visits. It’s a key measure of long-term loyalty. The industry, on average, sees about 40% retention, while top brands manage around 50%.

Customers often stay within a brand family when buying their next car, but it’s the service experience between purchases that builds or breaks loyalty. Routine maintenance appointments are a valuable touchpoint. Every visit is a chance to build trust and keep customers connected to the brand.

Key takeaways:

Insurance retention metrics track how often customers renew their policies and stay with the company over time. The number gives insurers a clear view of how well their offerings and their service are working. Insurers, on average, retain about 80% of their customers, while the best in the industry reach 85%.

ABC Insurance discovered that customers who had filed claims were more likely to leave. They introduced a dedicated claim concierge to personally guide customers through the process. The hands-on support helped reduce stress and improve retention among policyholders who had recently gone through a claim.

Pro tips:

Retention metrics in professional services, like consulting, legal and accounting, track how well firms maintain long-term client relationships. The numbers reflect both the quality of service and the strength of client trust. Firms retain about 70% of their clients, while top-performing firms reach around 75%.

Well-established firms often retain clients longer because of the strong relationships they’ve built over time. But successful project delivery is just as important. When clients see clear results, they’re more likely to return for future work and to expand the range of services they use.

Actionable tips:

Banking retention metrics track how well a financial institution holds on to its customers across checking, savings, loans and other services. The metrics reflect not just loyalty, but also long-term revenue stability. The average industry retention rate sits around 75%, while top banks reach 85%.

Customer trust is fragile in banking. Outdated apps, unclear fees or sudden branch closures can push people away, especially if there aren’t strong digital alternatives. Security issues and service outages make things worse, often causing permanent damage to the customer relationship.

Best practices:

Manufacturing retention metrics help track how well producers maintain long-term relationships with B2B clients across supply chains and production agreements. The metrics give manufacturers insight into relationship strength and help forecast future demand. The industry maintains an average retention rate of 80% while leading manufacturers achieve a benchmark of 90%.

Strong retention in the space often comes from deep operational ties, like integrated systems or tailored production workflows. While switching suppliers is complex and costly, the stability comes with high expectations. Clients expect consistency, quality and accountability. Long-term partnerships are built on reliable deliveries and successful project execution over time.

Key takeaways:

Hospitality retention metrics track how often guests return to a hotel brand or chain. The figures help operators understand guest satisfaction and forecast future bookings. Industry averages sit around 40%, with top brands reaching 50%.

Return rates vary based on property type, location and the kinds of travelers being served. The early experience matters: when service is consistent and thoughtful, guests are far more likely to come back. Retention is closely tied to how well a property delivers on expectations, not just once, but every time.

Pro tips:

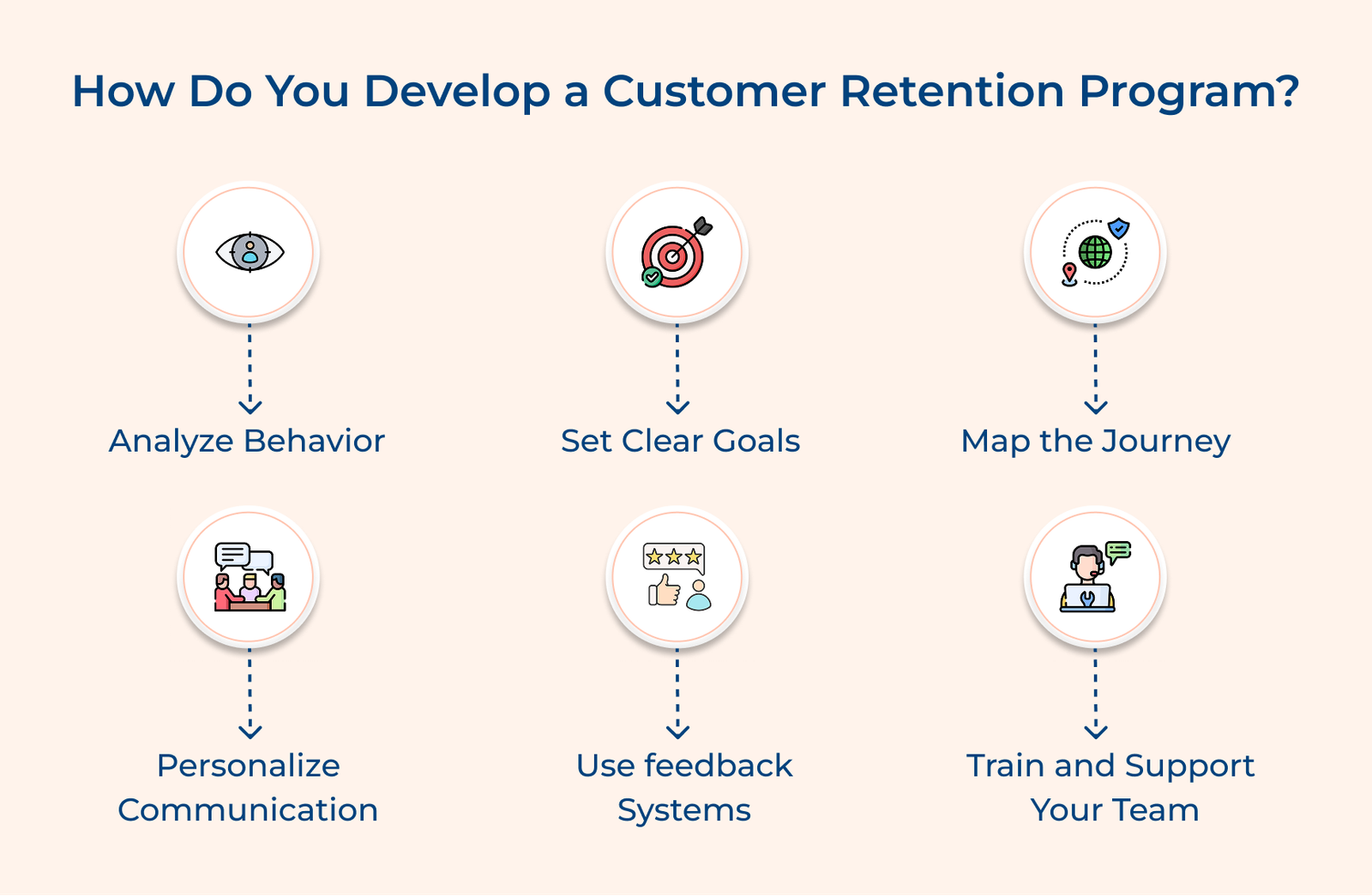

Check out the crucial steps that can help businesses develop a robust strategy to maintain strong customer relationships and encourage long-term loyalty.

Start by digging into your customer data. Look at what they buy, how often they engage with your service and where they drop off. Patterns in usage, purchases and support interactions can reveal what keeps them coming back or pushes them away.

Decide what success looks like. Set specific, trackable goals based on your business model and what’s realistic for your industry. Focus on both overall retention rates and what’s driving them, like onboarding success or repeat purchase frequency.

Sketch out each step your customers take, from their first interaction to long-term use. Mark the points where they’re more likely to leave or stay. The turning points help you identify where a small improvement could make a big difference.

Reach out in ways that match customer needs. Segment your audience by behavior or preferences and tailor your messages accordingly. Use automation to stay consistent, but know when a personal touch is necessary, especially when resolving issues.

Collect feedback consistently through surveys, forms and even social media comments. More importantly, use the input to fix real issues. Fast responses to customer concerns can often prevent churn before it starts.

Retention isn’t just a strategy; it’s something your whole team carries out. Train staff to spot risks early, handle issues quickly and maintain strong relationships. Give them the tools and authority to make things right without jumping through hoops.

Let’s go through some compelling examples of how different brands have successfully focused on customer retention across various industries.

1. Amazon (E-commerce)

Amazon’s Prime program goes well beyond free shipping. It bundles streaming, shopping perks and smart home integration into one seamless experience. Amazon tailors suggestions and anticipates what people might need next by analyzing customer behavior.

The ecosystem keeps customers coming back, not just to shop, but to stay connected across multiple parts of their daily routine. It’s a major reason Amazon users are less likely to switch to competitors.

2. Starbucks (Food & Beverage)

Starbucks’ mobile app makes ordering and paying simple, while also rewarding regular visits. Customers earn points, unlock offers and see personalized drink suggestions based on what they’ve ordered before.

The mix of convenience and personalization keeps users engaged. It encourages more visits, higher spending and builds loyalty even during uncertain economic times.

3. Netflix (Entertainment)

Netflix uses viewing data to recommend shows that match each user’s taste. Their original content keeps people curious, while their interface makes it easy to pick up where you left off or explore something new.

Profiles for different users ensure a personalized experience for everyone in the household. The focus on relevance and ease of use helps Netflix keep users watching, even as new streaming services enter the market.

4. American Express (Financial Services)

American Express builds loyalty by offering more than just points. Cardholders get access to event tickets, personalized travel help and curated offers. Their customer service focuses on resolving issues quickly and supporting long-term relationships.

The added benefits make cardholders feel valued, something that keeps many from switching, even if other cards offer higher cashback.

5. Delta Air Lines (Travel)

Delta redesigned its loyalty program to reward the full travel experience and not just miles. Frequent fliers get priority upgrades, real-time app updates and proactive support during delays.

They’ve also partnered with other premium brands to expand their perks. The proactive approach builds trust and keeps travelers coming back, especially those who value consistent service over price.

Retention rates are shaped by how well a business meets customer expectations and adapts to changing needs. Each sector faces its own challenges, so there’s no universal formula for keeping customers around.

What works best is a clear understanding of why people stay. It might mean consistent service, helpful communication or simply making the experience smooth from start to finish. Listening to real customer feedback and tracking the right metrics helps companies spot what matters.

Key takeaways:

The customer retention rate is calculated using a specific formula: ((Number of customers at the end – New customers acquired) / Number of customers at the start) × 100. You’ll need three: how many customers you had at the beginning, how many you gained and how many you ended with. The result tells you what percentage of customers stayed.

Keeping customers is cheaper than finding new ones. People who stick around usually spend more, refer others and give more useful feedback. High retention means your product or service is working and your business is on stable ground.

Multiple factors influence retention, including product quality, customer support, pricing strategies and market competition. Industry-specific factors like contract lengths, service complexity and switching costs play crucial roles. How you communicate with customers, support them at critical moments and deliver on what you promise often determines if they stay or walk away.

Creating an effective retention program starts with studying your current customers. It requires developing personalized communication strategies, implementing strong feedback systems and training your team. The program should focus on identifying at-risk customers early, providing consistent value and creating emotional connections that encourage long-term loyalty.

Good retention rates vary significantly by industry, with SaaS companies typically aiming for 90%+ while retail might consider 65% strong. Understanding industry benchmarks helps set realistic goals, but businesses should also consider their specific circumstances, market position and customer base when evaluating their retention performance.

Retention should be measured regularly, with frequency depending on your business cycle and industry. Most businesses track monthly, quarterly and annual retention rates. Shorter measurement periods help identify immediate issues while longer periods reveal sustained patterns.

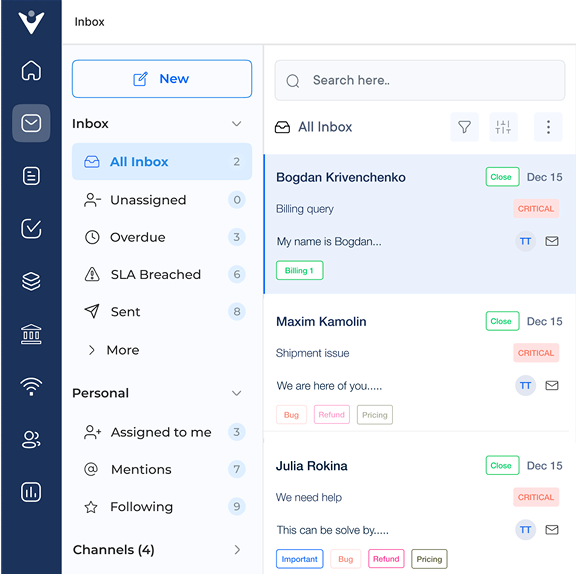

Market better, sell faster and support smarter with Veemo’s Conversation Customer Engagement suite of products.

Unify all your customer data in one platform to deliver contextual responses. Get a 360 degree view of the customer lifecycle without switching tools.

Connect with the tools you love to reduce manual activities and sync your business workflows for a seamless experience.

https://veemo.io/wp-content/uploads/2025/12/Customer-experience-mapping.png

1258

2400

indrasish5342@gmail.com

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

indrasish5342@gmail.com2026-01-23 09:40:142026-01-13 09:49:23What is Customer Experience Mapping? 9 Easy Steps

https://veemo.io/wp-content/uploads/2025/12/Customer-experience-mapping.png

1258

2400

indrasish5342@gmail.com

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

indrasish5342@gmail.com2026-01-23 09:40:142026-01-13 09:49:23What is Customer Experience Mapping? 9 Easy Steps https://veemo.io/wp-content/uploads/2025/12/Evaluate-Customer-Service.png

1256

2400

indrasish5342@gmail.com

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

indrasish5342@gmail.com2026-01-13 09:22:162025-12-24 09:26:44How to Evaluate Customer Service? The Complete Guide

https://veemo.io/wp-content/uploads/2025/12/Evaluate-Customer-Service.png

1256

2400

indrasish5342@gmail.com

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

indrasish5342@gmail.com2026-01-13 09:22:162025-12-24 09:26:44How to Evaluate Customer Service? The Complete Guide https://veemo.io/wp-content/uploads/2025/12/After-sales-service.png

1257

2400

indrasish5342@gmail.com

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

indrasish5342@gmail.com2025-12-30 09:29:092026-01-13 09:31:29After-sales Service Guide: Types, Examples & Tips

https://veemo.io/wp-content/uploads/2025/12/After-sales-service.png

1257

2400

indrasish5342@gmail.com

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

indrasish5342@gmail.com2025-12-30 09:29:092026-01-13 09:31:29After-sales Service Guide: Types, Examples & TipsGrow Customer Relationships and stronger team collaboration with our range of products across the Conversational Engagement Suite.

What is CRM Technology: Benefits, Types and Challenges

Scroll to top

What is CRM Technology: Benefits, Types and Challenges

Scroll to top