1. Customer Service and Support

Conversational AI offers 24/7 support for routine customer inquiries, providing quick answers to questions about account balances, transaction history and branch locations. The technology reduces operational costs by up to 30%, boosts response times and enhances customer satisfaction, allowing human agents to focus on more complex issues that require empathy.

Let’s assume that Bank of America’s virtual assistant, Erica, helps customers with tasks like bill payments, transaction searches and credit score monitoring. Customers can simply ask questions like “Show me my recent transactions” or “When is my credit card payment due?” and receive instant, accurate answers. The AI-driven support improves service accessibility and has been linked to higher customer retention rates as clients benefit from faster interactions.

Pro tips:

- Begin with a targeted set of common queries and expand over time based on user data.

- Establish a seamless handoff system to transfer complex issues to human agents while preserving conversation context.

2. Account Management

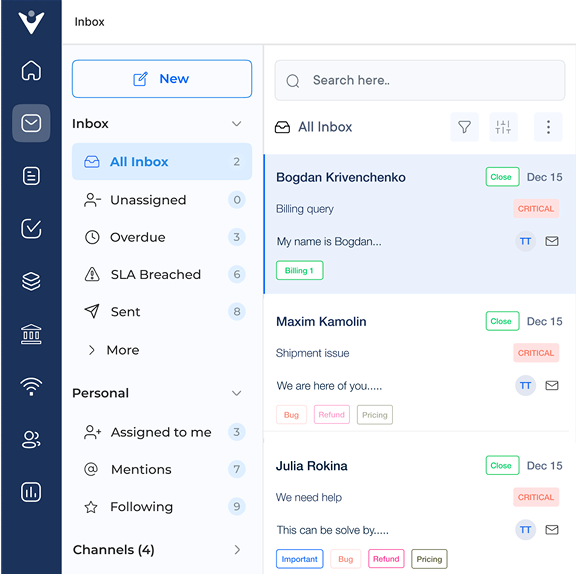

Conversational AI allows customers to manage their accounts through simple, natural conversations. Tasks like checking balances, reviewing transactions, setting alerts and adjusting preferences are all handled seamlessly, with real-time account updates powered by integration with core banking systems.

AI reduces the need for branch visits and call center interactions by enabling digital account management. Banks experience improved operational efficiency, increased customer engagement and greater utilization of digital banking features. Let’s consider that a regional bank’s AI chatbot lets customers easily set savings rules with commands like “Save $100 every payday” or “Alert me when my balance drops below $500.”

Actionable tips:

- Design conversation flows that minimize the number of steps needed to complete common account management tasks.

- Incorporate proactive notifications and reminders for key account actions or upcoming deadlines.

3. Payment and Money Transfers

Users can easily initiate transfers, schedule payments or manage recurring transactions with natural language commands. The system securely verifies, confirms and executes transactions while adhering to strict security protocols.

The seamless payment experience reduces processing time, minimizes errors and enhances user satisfaction. The convenience of voice or chat-based payments is especially popular among younger users, streamlining their financial interactions. Let’s assume that a customer might simply say, “Send $50 to John for dinner,” and the AI assistant quickly completes the transaction, confirming all details.

Best practices:

- Ensure robust authentication while keeping conversations seamless.

- Implement clear confirmation steps for all transactions to minimize errors and enhance security.

4. Financial Advisory Services

Conversational AI delivers personalized financial advice by analyzing spending habits, goals or data to offer budgeting tips, investment suggestions and financial planning. It makes financial guidance more accessible to all customers, even those who typically avoid traditional advisory services.

AI-driven advice boosts customer engagement with investment products and enhances financial literacy. Let’s assume that an AI advisor tracks spending patterns and recommends a tailored budget, offering regular updates or adjusting suggestions as goals progress.

Pro Tips:

- Leverage customer transaction data and life events to offer timely, relevant financial advice.

- Integrate educational insights within the conversation to enhance financial literacy and empower customers to make informed decisions.

5. Fraud Detection and Security

Conversational AI boosts security by monitoring transactions and user behavior, instantly alerting customers to potential fraud through natural conversation. It verifies suspicious activities in real time, guiding users through security processes and resolving concerns.

AI-driven fraud detection reduces losses and builds customer trust by enabling rapid response, ensuring a more reliable banking experience.

How to implement:

- Develop clear escalation paths for different types of security concerns with appropriate urgency levels.

- Integrate seamless multi-factor authentication into conversations for secure, sensitive transactions.

6. Product Recommendations

AI systems analyze customer data and behaviors to offer personalized product recommendations through natural conversations. The AI explains features, compares options and guides customers in selecting the best solutions for their needs.

The personalized approach boosts product adoption, enhances customer satisfaction and drives cross-selling success. Banks see increased customer lifetime value by delivering timely, relevant recommendations. Imagine a customer mentioning having savings for college. The AI suggests suitable education savings plans and investments, helping compare options through interactive dialogue.

Actionable tips:

- Use life events and transaction patterns to time product recommendations appropriately.

- Highlight key benefits and value propositions in recommendation conversations to make them more relevant for customers.

7. Onboarding and Documentation

Conversational AI simplifies onboarding by guiding customers through account setup, document submission and verification. It answers questions, validates documents and provides real-time updates, ensuring a smooth process.

The AI-driven approach accelerates account openings, reduces operational costs and enhances customer satisfaction with faster, more efficient onboarding while ensuring compliance. Let’s assume that a new customer starts their account setup via chat, with the AI assistant capturing information and using OCR to verify documents instantly.

Pro tips:

- Simplify complex onboarding by breaking it into easy, conversational steps with clear progress indicators.

- Include instant FAQ responses within the flow to address common concerns and keep customers informed.

Conversational AI Banking Example

The following are five examples of how conversational AI is revolutionizing the banking landscape, showcasing successful implementations that enhance engagement.

1. Bank of America – Erica

Erica, Bank of America’s virtual assistant, helps customers with account inquiries, bill payments, transaction history and budgeting advice, all through natural language processing in the mobile app. Erica has reduced call center volume, cut operational costs and enhanced customer satisfaction with instant financial guidance by offering 24/7 assistance, empowering customers to make smarter financial decisions.

2. Capital One – Eno

Eno, Capital One’s virtual assistant, monitors accounts for suspicious activity, manages credit cards and supports online shopping with virtual card numbers. It delivers proactive alerts through text and browser extensions for enhanced financial security. Eno has boosted customer trust by strengthening fraud prevention and offering seamless account management, providing real-time protection digital banking experience.

3. HSBC – Amy

Amy, HSBC’s virtual assistant, helps customers with routine banking queries, account openings and personalized product recommendations. It offers instant support for common questions through web and mobile interfaces. Amy has freed up human staff to address more complex customer needs by streamlining onboarding and reducing time spent on routine tasks, ensuring consistent service quality across the board.

4. DBS Bank – POSB Digibank Virtual Assistant

The AI assistant supports customer service across channels like WhatsApp and Facebook Messenger. It handles fund transfers, bill payments and real-time transaction updates in multiple languages. The assistant has boosted customer engagement, reduced response times and efficiently managed increased service volumes by enhancing DBS’s digital presence, all while serving a diverse customer base.

5. JPMorgan Chase – Digital Assistant

Chase’s AI assistant streamlines treasury services for corporate clients, handling payment inquiries, account details and routine transactions with precision. The assistant has boosted operational efficiency, enhanced client satisfaction and eased the workload for treasury teams by delivering fast, accurate responses to complex queries.

How to Develop a Conversational AI Banking Experience

Let’s explore how to build a seamless conversational banking experience that delights customers and drives engagement, setting your institution apart.