Measuring Digital Retail CX

1. Customer Satisfaction Surveys (CSAT)

CSAT surveys gauge customer satisfaction with a specific interaction or overall experience using a rating scale.

How to measure:

Send post-purchase or post-interaction surveys with a 1-5 or 1-10 rating scale, asking questions like “How satisfied were you with your recent purchase?” Calculate the average score or the percentage of customers who rate 4 or 5.

CSAT offers direct insights into customer perceptions, highlighting areas for improvement. High satisfaction scores are linked to stronger loyalty and positive word-of-mouth, driving business growth.

2. Net Promoter Score (NPS)

NPS measures customer loyalty and their likelihood to recommend your brand. Customers are classified as promoters, passives or detractors based on their responses to a single question.

How to measure:

Ask, “On a scale of 0-10, how likely are you to recommend our brand?” Subtract the percentage of detractors (0-6) from promoters (9-10) to calculate your NPS, which ranges from -100 to +100.

NPS is a key indicator of loyalty and business growth. High NPS scores drive customer retention, word-of-mouth and revenue while highlighting areas for improvement.

3. Customer Effort Score (CES)

CES measures how easy it is for customers to interact with your company, focusing on minimizing friction in their journey.

How to measure:

After an interaction, ask, “On a scale of 1-7, how easy was it to resolve your issue or complete your task?” Calculate the average score or the percentage of customers who rated the experience as easy (5-7 on a 7-point scale).

Low-effort experiences boost loyalty and satisfaction. Companies can improve retention, cut service costs and enhance the customer experience by eliminating pain points.

4. Customer Loyalty

Customer loyalty reflects how likely customers are to continue buying from a brand, including repeat purchases, brand preference and emotional attachment.

How to measure:

Track repeat purchase rates, customer lifetime value (CLV) and churn. Analyze purchase frequency and average order value. Use surveys to gauge brand affinity and monitor loyalty program engagement.

Loyal customers drive long-term growth. They spend more, try new products and often become brand advocates. Measuring loyalty helps identify at-risk customers and opportunities to deepen relationships.

5. Employee Engagement

Employee engagement gauges the emotional commitment and motivation employees have toward their work, directly influencing customer service quality.

How to measure:

Conduct employee surveys on job satisfaction, alignment with company values and willingness to exceed expectations. Track metrics like eNPS, turnover rates and productivity.

Engaged employees deliver superior customer service, boosting satisfaction and loyalty. High engagement drives productivity, innovation and reduces turnover, positively impacting the overall customer experience.

Measuring In-Store Retail CX

1. Foot Traffic and Conversion Rate

Foot traffic tracks how many people enter a store, while conversion rate measures the percentage of visitors who make a purchase. Together, they reveal store performance.

How to measure:

Use people counters or video analytics for foot traffic and calculate conversion rate by dividing transactions by total visitors. Track trends over time and compare them to benchmarks.

The metrics highlight store appeal and sales effectiveness. Low foot traffic may signal marketing or location issues, while low conversion rates point to in-store experience gaps.

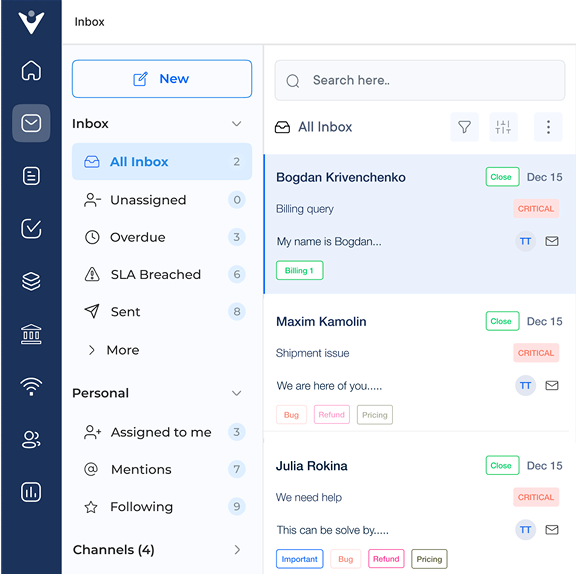

2. Customer Feedback

Customer feedback includes all customer input on their in-store experience, comments, complaints and suggestions offering valuable qualitative insights to complement data-driven metrics.

How to measure:

Use in-store feedback kiosks, post-visit surveys and mystery shopping programs. Monitor social media and reviews for customer mentions. Analyze themes and sentiment with text analytics tools.

The feedback uncovers improvement opportunities that numbers alone can’t reveal, helping personalize experiences, identify training gaps and drive continuous improvements in-store.

3. Staff Performance and Customer Interactions

The metric evaluates how effectively store staff engage with customers, from greetings and product knowledge to problem-solving. It directly shapes the in-store experience.

How to measure:

Use mystery shopping, customer surveys on staff interactions and video analytics to track engagement. Monitor individual sales performance and conversion rates.

Positive staff engagement boosts customer satisfaction, drives sales and enhances loyalty. Measuring staff performance highlights training needs, rewards top performers and ensures consistent, high-quality experiences across stores.

Retail Customer Experience Examples

Following are the impactful retail customer experience examples that not only thrilled consumers but also set benchmarks in the industry.

1. Nike’s House of Innovation

Strategy: Nike launched its “House of Innovation” flagship stores in New York, Shanghai and Paris, offering tech-driven, personalized shopping experiences. The Nike App at Retail lets customers scan products, check inventory, request try-ons and purchase directly via their phones. Customization studios allow shoppers to design their shoes.

Impact: The innovative approach boosted Nike’s direct-to-consumer sales by 32% in 2021, reaching $16.4 billion nearly 39% of total revenue. The enhanced in-store experience has strengthened brand loyalty and driven repeat purchases.

2. Sephora’s Digital Makeover

Strategy: Sephora revolutionized the in-store experience with its digital innovations. The “Color IQ” system matches customers with their perfect foundation by scanning their skin, while the mobile app’s augmented reality lets users virtually try on makeup. In-store digital displays and touchscreens provide product info.

Impact: The tech-driven enhancements boosted customer engagement and sales. Sephora’s virtual try-on feature increased conversions by 75%, contributing to a 29% revenue surge in LVMH’s Selective Retailing segment in 2021, with Sephora driving much of the growth.

3. Walmart’s Omnichannel Approach

Strategy: Walmart enhanced its omnichannel experience by merging online and in-store services. It expanded curbside pickup, revamped its app for easier checkout and introduced “Scan & Go” technology, allowing customers to scan.

Impact: Walmart’s e-commerce sales surged by 79% in 2021, driven by its omnichannel efforts. The company also saw a 6% increase in comparable store sales, reflecting higher customer satisfaction and more frequent visits.

4. Nordstrom’s Personal Styling Service

Strategy: Nordstrom introduced “Trunk Club” (later rebranded as “Nordstrom Trunk Club”) to offer personalized shopping experiences. Customers complete a style profile online and a personal stylist curates items tailored to their tastes, which are then shipped for at-home try-on.

Impact: Although specific revenue figures weren’t disclosed, Nordstrom found that customers using Trunk Club spend five times more than average. The service has also helped attract younger shoppers and strengthened Nordstrom’s competitive edge in the retail market.

5. Lowe’s Innovation Labs

Strategy: Lowe’s launched Innovation Labs to explore new technologies that elevate the customer experience. They introduced the Holoroom, a virtual reality tool that helps customers design and visualize home improvement projects, alongside in-store robots to assist with product searches.

Impact: While Lowe’s hasn’t shared specific numbers, their customer satisfaction scores and in-store efficiency have improved. The company reported a 24.2% increase in comparable sales in 2021, driven in part by these innovative customer experience initiatives.

The Future of Customer Experience in Retail

Join us as we explore the key trends shaping the future of customer experience in retail, highlighting what businesses must do to thrive in the rapidly evolving environment.