How to Calculate Net Promoter Score (NPS)?

Learn how to calculate Net Promoter Score (NPS), offering actionable steps to assess customer loyalty, enhance satisfaction and drive business improvements by interpreting NPS results effectively.

Learn how to calculate Net Promoter Score (NPS), offering actionable steps to assess customer loyalty, enhance satisfaction and drive business improvements by interpreting NPS results effectively.

Understanding customer loyalty is crucial for success. Many businesses struggle to accurately measure customer sentiment, leading to flawed decisions and missed opportunities. The Net Promoter Score (NPS) offers a simple yet powerful solution to measure and improve loyalty. 80% of executives consider NPS to be a good measure of customer loyalty.

We’ll break down the entire way on how to calculate Net Promoter Score (NPS), including its formula, real-world examples and show you how to interpret results to drive meaningful improvements. If you’re new to NPS or aiming to refine your strategy, the step-by-step guide will help you master the vital metric.

Net Promoter Score (NPS) refers to a powerful metric that measures customer loyalty by measuring how likely customers are to recommend a company’s products or services to others. Introduced by Fred Reichheld in 2003, NPS has become a key benchmark for customer satisfaction.

The process involves asking customers: “On a scale of 0-10, how likely are you to recommend our company/product/service to a friend or colleague?” Based on responses, customers fall into three categories: Promoters (9-10) who are loyal enthusiasts, Passives (7-8) who are satisfied but unenthusiastic and Detractors (0-6) who are unhappy customers. The final NPS is calculated by subtracting the percentage of Detractors from the percentage of Promoters, yielding a score from -100 to +100.

Key objectives:

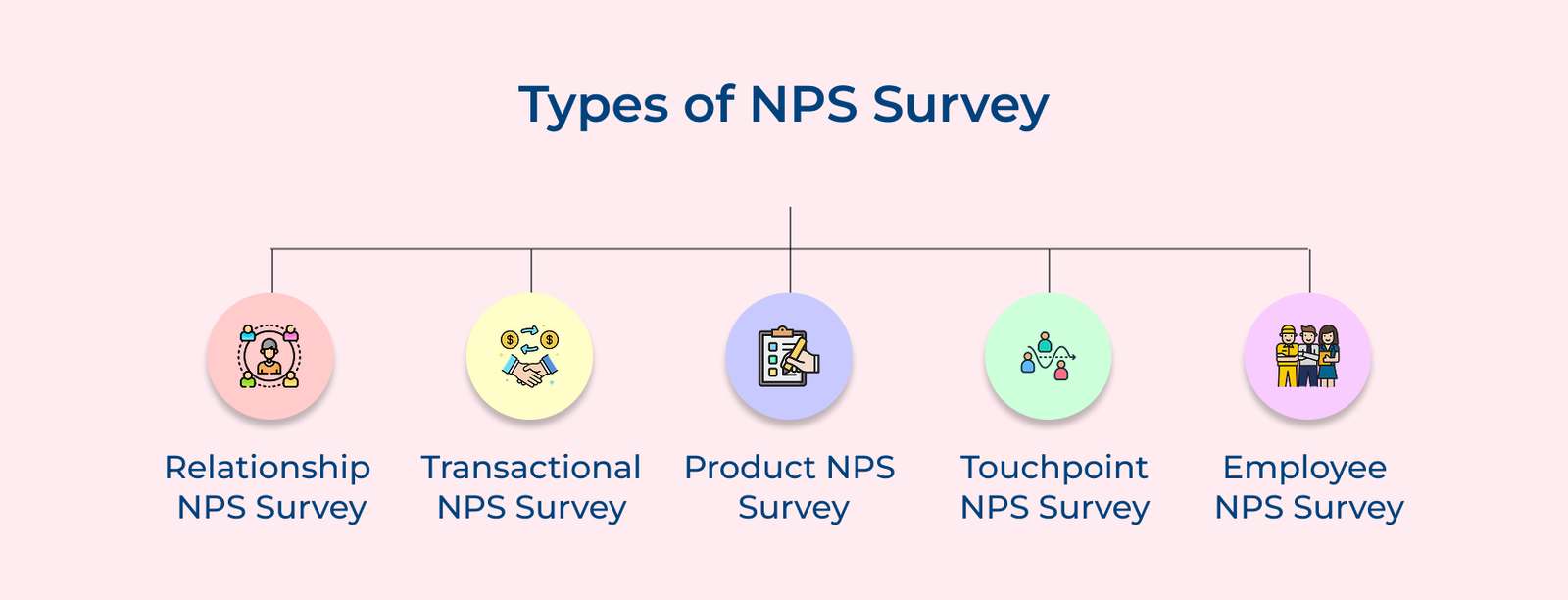

Let’s go through the different types of NPS surveys, each designed to provide valuable insights into customer loyalty and satisfaction.

Relationship NPS survey assesses overall customer satisfaction and loyalty across all brand interactions. Conducted quarterly or annually, they reveal long-term trends in customer sentiment and brand perception over time.

Transactional NPS surveys gather immediate feedback on specific interactions, such as purchases or customer service. They help identify pain points and enable quick, targeted improvements by targeting key touchpoints.

Product-focused NPS surveys assess customer satisfaction with specific products or features. The insights gathered guide product development, feature prioritization and improvements, especially for businesses with diverse offerings.

Touchpoint surveys measure satisfaction at key stages of the customer journey, from initial contact to post-purchase support. The insights reveal which interactions most influence loyalty, guiding improvements and resource allocation.

Employee NPS (eNPS) surveys measure employee satisfaction by asking how likely they are to recommend their workplace. The feedback helps improve company culture, identify issues and boost customer experiences.

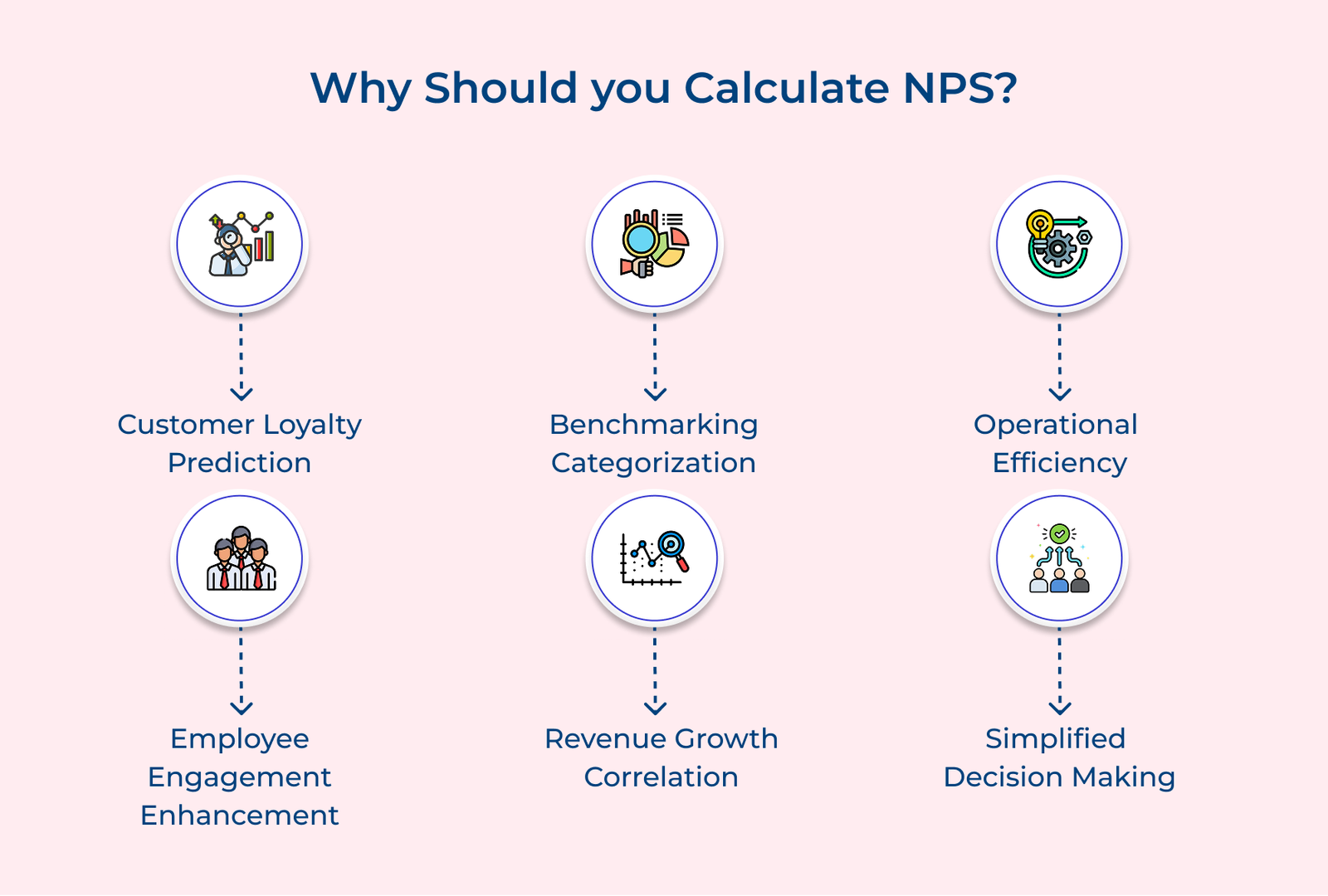

The following are the key reasons why calculating NPS is crucial for understanding customer loyalty and driving business growth by gaining actionable insights.

Customer Loyalty Prediction

NPS is a strong predictor of customer loyalty and future business success. You can forecast retention, repeat sales and organic growth by measuring customers’ likelihood to recommend your business. The insight helps guide strategic decisions on customer relationships.

Benchmarking Categorization

NPS offers a standardized metric for comparing your business with competitors and industry leaders. It helps gauge market position, identify best practices and set achievable improvement targets.

Operational Efficiency

Calculating NPS uncovers areas for operational improvement by revealing bottlenecks and pain points in customer interactions. The insight helps companies prioritize resources and make targeted changes to boost satisfaction.

Employee Engagement Enhancement

NPS data ties performance to specific teams or employees, enhancing accountability and motivating exceptional customer service. When staff see the impact of their actions on satisfaction, it drives continuous improvement.

Revenue Growth Correlation

Studies show a clear link between high NPS scores and revenue growth. Tracking NPS improvements helps businesses boost customer spending, reduce churn and increase customer lifetime value, justifying investments in customer experience.

Simplified Decision Making

NPS offers a straightforward metric to guide strategic decisions. Leadership can align teams across the organization to enhance overall customer satisfaction by focusing on a single, customer-centric measure.

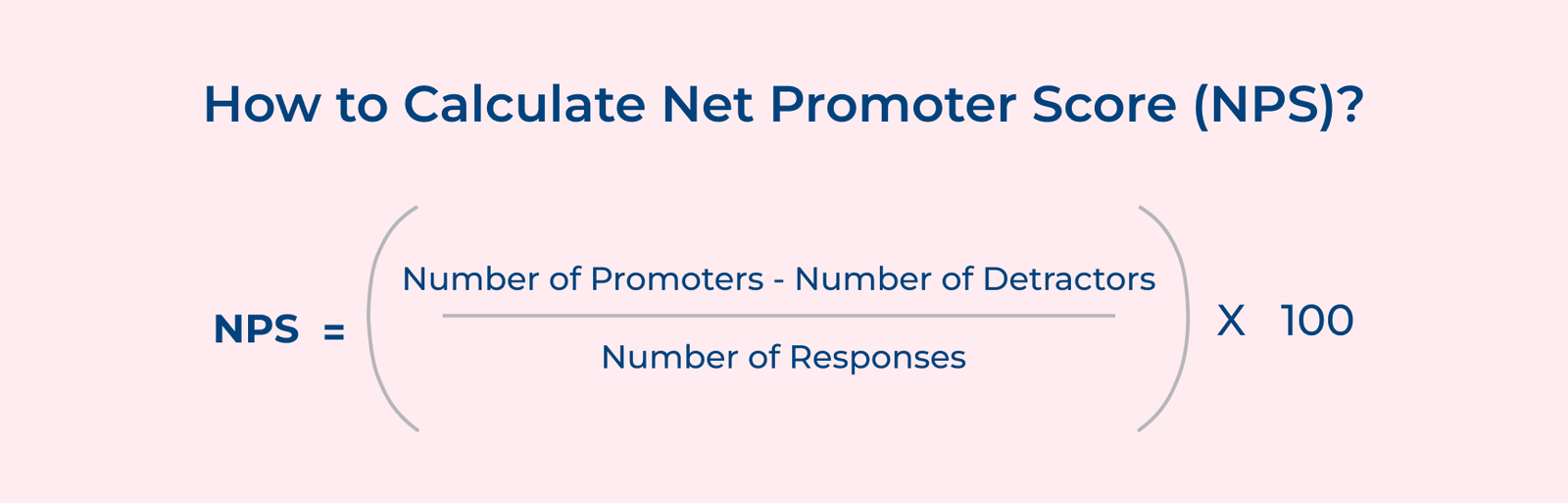

Check out the simple steps to calculate your Net Promoter Score (NPS) and understand how the powerful metric can provide valuable insights into customer loyalty.

NPS = (Percentage of Promoters – Percentage of Detractors) × 100

Components of NPS Formula:

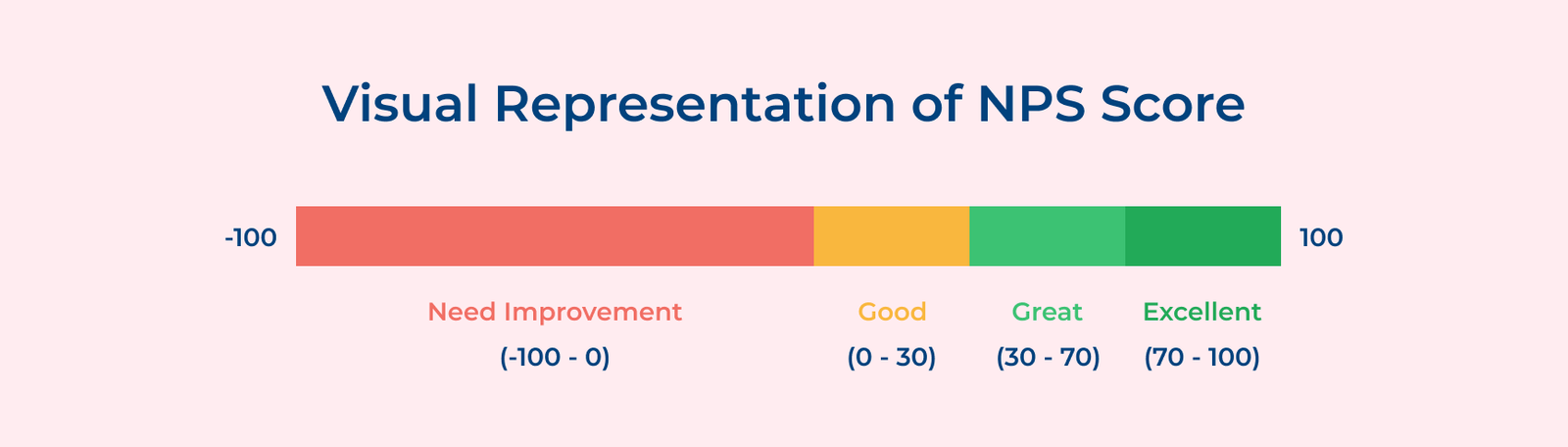

NPS is usually visualized on a gauge or slider, ranging from -100 to +100 and color-coded from red (negative) to yellow (neutral) to green (positive scores), making it easy to interpret and track changes over time.

1. Promoters in NPS Score (9-10)

Promoters are loyal customers who not only choose your products or services repeatedly but also actively recommend them. They drive positive word-of-mouth, have a high customer lifetime value and enhance long-term engagement.

2. Passives in NPS (7-8)

Passives are satisfied customers but lack strong loyalty and enthusiasm. While they’re content with your service, they could easily be swayed by competitors offering better deals or features.

3. Detractors in NPS (0-6)

Detractors are unhappy customers who can harm your brand’s reputation through negative word-of-mouth. They’re more likely to share their negative experiences and deter others from choosing your business.

Gather all customer feedback from the NPS question “How likely are you to recommend our product/service to others?” Record responses on the 0-10 scale.

Sort responses into their respective categories: Promoters (9-10), Passives (7-8 and Detractors (0-6). Count the total number in each group.

Divide the number of responses in each category by the total responses, then multiply by 100 to get percentages for both Promoters and Detractors.

Subtract the percentage of Detractors from the percentage of Promoters to calculate your raw NPS score.

Multiply the result by 100 if working with decimals, or keep it as is for whole number percentages to get your final NPS score.

Let’s assume that you surveyed 200 customers with the following results:

– 80 Promoters (40%)

– 70 Passives (35%)

– 50 Detractors (25%)

NPS = (% of Promoters – % of Detractors)

NPS = (40% – 25%)

NPS = 15

Your NPS is +15, indicating a positive but moderate level of customer loyalty. While there’s room for improvement, having more promoters than detractors is a good sign overall.

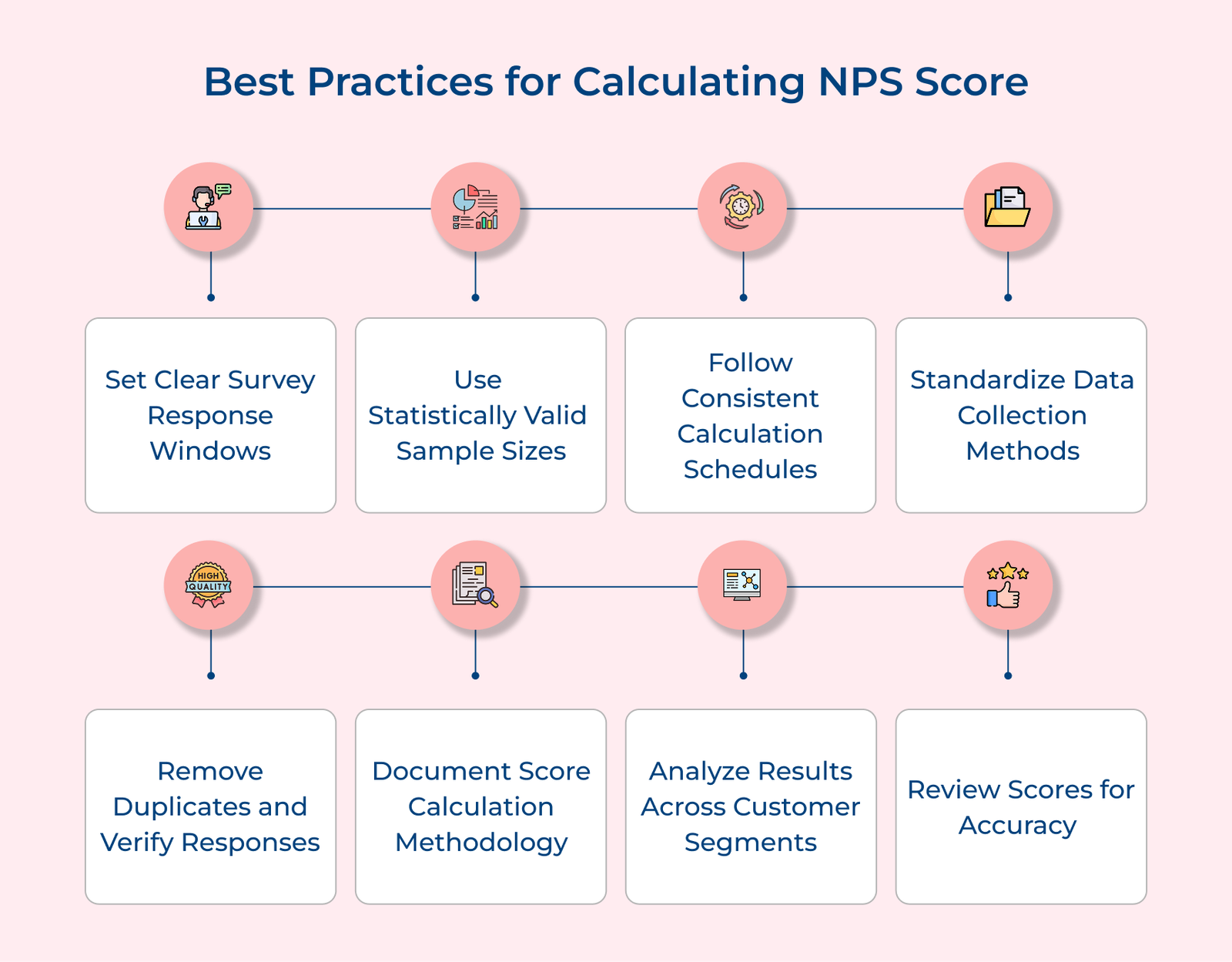

Following are the essential practices for accurately calculating your NPS score, steering you toward more informed business decisions and enhancing deeper customer loyalty.

Establishing clear survey response windows ensures consistent, timely feedback that accurately reflects current customer sentiment. You can avoid mixing feedback from different business phases by setting specific timeframes.

Start by determining appropriate survey intervals based on your customer interaction frequency. Set windows immediately after purchase or service completion for transactional surveys. Aim for quarterly or annual intervals for relationship surveys. Keep an eye on response rates to adjust timing as needed.

Pro tips:

A statistically significant sample size ensures your NPS results accurately reflect your entire customer base, minimizing errors and providing reliable insights for better decision-making. Without adequate sample sizes, your results might reflect only a narrow segment of customers.

Start by calculating your total customer population size and using sample size calculators to determine the minimum responses needed. Boost response rates by optimizing survey timing and sending targeted reminders for better representation across segments.

Actionable tips:

Regular NPS calculation schedules ensure consistent tracking of customer satisfaction trends, providing timely insights for decision-making. The systematic approach helps identify patterns and keeps stakeholders informed.

Create a standardized calculation calendar aligned with reporting cycles, automate data processing workflows and set up dashboards that update automatically for consistent analysis.

Key takeaways:

Standardizing data collection ensures consistency, making customer feedback comparable across periods and segments. It reduces variables that could skew NPS calculations and supports reliable trend analysis.

Document survey distribution processes and define consistent question wording as well as response options. Train team members on proper data collection procedures to ensure everyone follows the same protocols.

Pro tips:

Data cleaning and validation are key to accurate NPS calculations. The process involves removing duplicates and ensuring survey responses are authentic, reflecting true customer sentiment.

Set clear validation rules and automate duplicate detection based on customer identifiers. Verify response completeness and authenticity before including data in NPS calculations. Conduct regular data audits to ensure integrity.

Best practices:

A well-documented NPS computation methodology is essential for consistent calculations across teams and periods. It provides clear guidelines from data collection to final score generation, ensuring uniformity and easy onboarding for new team members.

Start by creating a detailed, step-by-step guide that covers the entire NPS process, from data gathering to score calculation. Include explanations of formulas, special cases, rounding rules and flowcharts to illustrate the process.

Pro tips:

Customer segmentation analysis provides insights into how satisfaction varies across different groups, helping you pinpoint areas of strength and improvement. It goes beyond overall NPS scores by revealing how different experiences impact loyalty among diverse demographics and usage patterns.

Start by identifying key customer segments based on factors like purchase history or service usage. Calculate NPS for each segment, using a consistent methodology and track changes over time. Use visual tools to highlight significant segment differences and guide actionable decisions.

Key takeaways:

Regular accuracy reviews are essential for maintaining the quality and credibility of your NPS program. The reviews help catch errors early, ensuring your methodology is applied consistently and your insights remain reliable.

Establish a regular review schedule with both automated checks and manual verifications. Use a checklist to validate key points, such as sample size and segment distribution. Implement peer reviews for complex calculations and create clear procedures for error correction. Set up alerts for unusual patterns or significant score changes that need immediate attention.

Pro tips:

Continuous improvement cycles turn your NPS calculation process into a dynamic, evolving system. You ensure that your measurements grow more accurate and insightful over time by regularly refining your methods.

Hold quarterly review meetings to assess the effectiveness of your current methods. Create feedback loops that gather insights from both data analysts and business users, testing improvements alongside existing practices. Incorporate emerging industry best practices to keep your process current and effective.

Actionable tips:

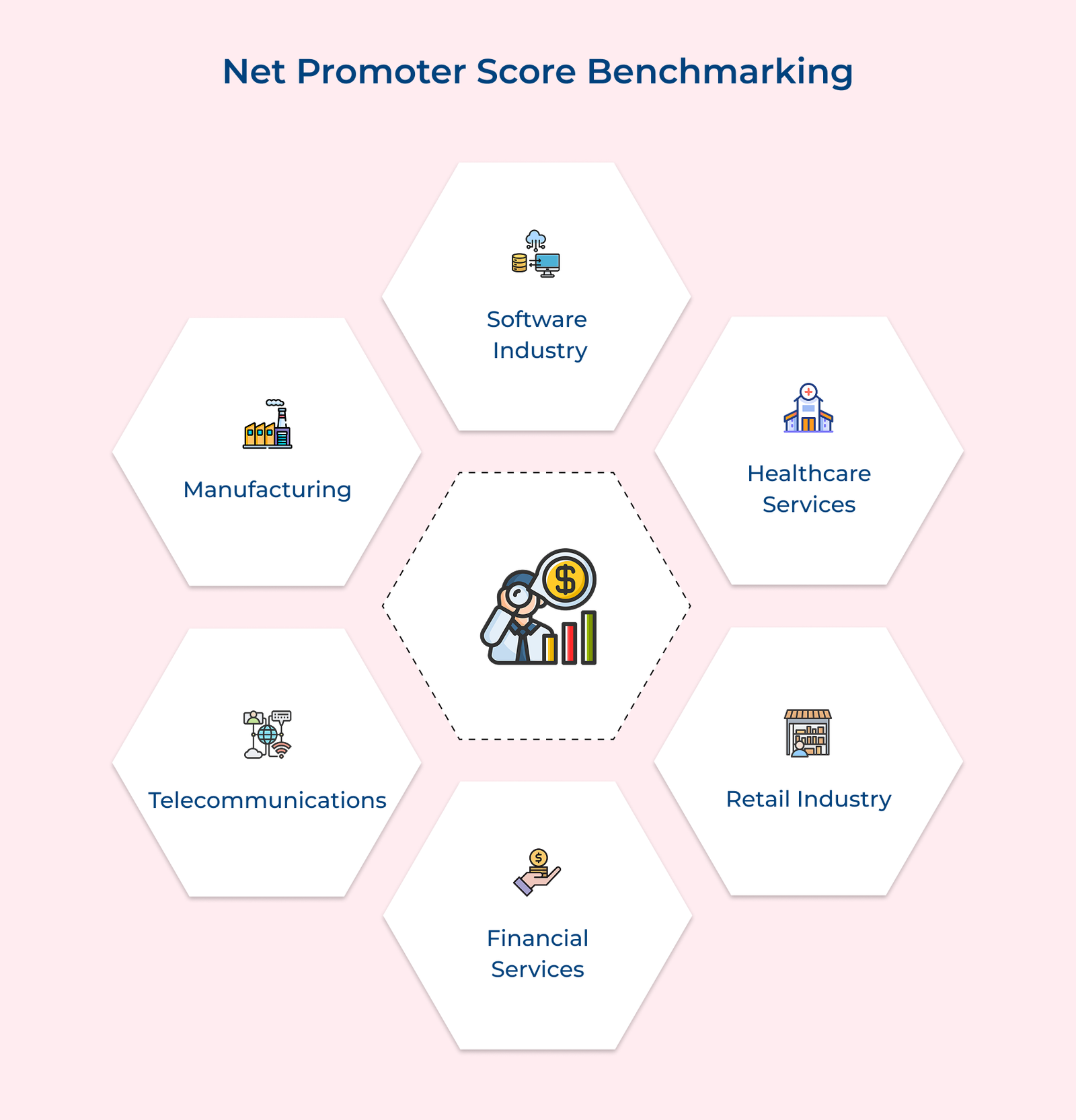

Explore the concept of Net Promoter Score benchmarking, learning how comparing your NPS to industry standards can provide valuable insights.

1. Technology/Software Industry

The tech sector boasts high NPS benchmarks, usually between +35 to +45. It reflects a strong focus on user experience, frequent product upgrades, responsive customer support and intense competition driving superior service.

2. Healthcare Services

Healthcare services typically achieve NPS scores ranging from +15 to +30. The moderate benchmarks stem from the complexity of care, patient expectations, wait times, insurance issues and the emotional impact of healthcare experiences.

3. Retail Industry

Retail leaders often score between +30 to +40 on NPS. The factors reflect the industry’s focus on customer experience, driven by product quality, store atmosphere, return policies and competitive pricing, with online integration playing an increasing role.

4. Financial Services

The financial sector typically sees NPS scores ranging from +20 to +35. The scores reflect the importance of transaction security, fee structures, digital services and trust in customer satisfaction.

5. Telecommunications

Telecommunications companies usually have NPS scores between +10 to +25, influenced by factors like service reliability, customer support, pricing and contract terms. Market competition also affects customer loyalty.

6. Manufacturing

Manufacturing companies typically score between +25 to +40 on NPS, driven by product quality, reliability and after-sales service. Factors like durability, warranty fulfillment and strong B2B partnerships play key roles.

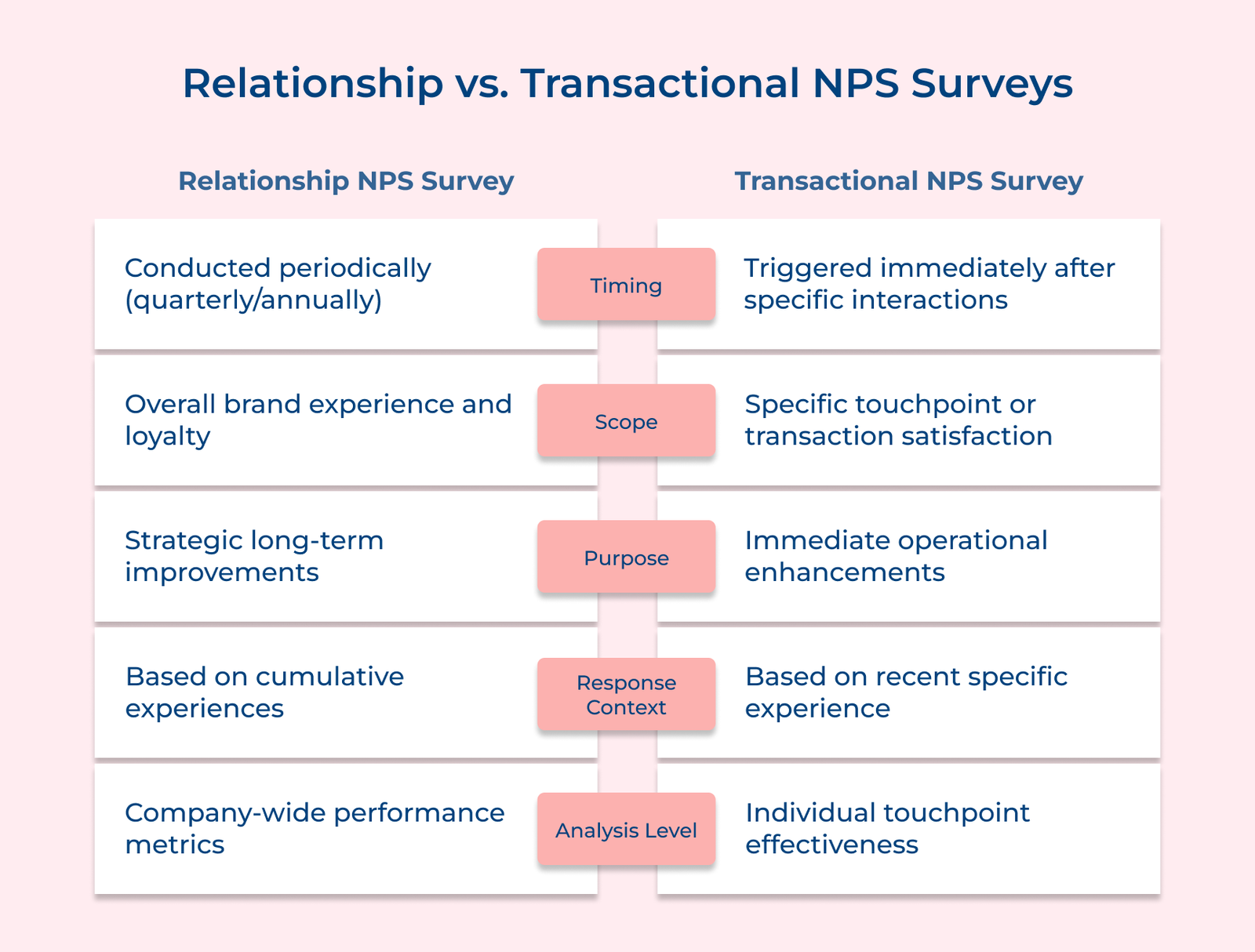

Following are the key differences between relationship and transactional NPS surveys. Going through them will help you understand how each type helps measure customer loyalty and satisfaction.

1. Timing and Frequency

Relationship NPS surveys are conducted on a regular schedule, usually quarterly or annually to track long-term trends and shifts in brand perception over time.

Transactional NPS surveys are triggered by specific interactions, providing real-time feedback about recent customer experiences while the details are fresh.

2. Scope of Measurement

Relationship surveys assess overall customer sentiment, capturing their perception of your brand across all interactions and experiences over time.

Transactional surveys focus on specific touchpoints, offering insights into satisfaction with particular service aspects and identifying areas for improvement.

3. Strategic Purpose

Relationship NPS guides long-term strategy by revealing overall brand health and loyalty trends, helping organizations understand their competitive position as well as guide broad improvement initiatives.

Transactional NPS offers immediate insights, pinpointing specific issues to address quickly and enhance customer experience.

4. Context of Responses

Relationship surveys capture a broader view, reflecting customers’ overall experiences and emotions with the brand over time, offering a comprehensive perspective.

Transactional surveys focus on interactions, providing immediate, actionable feedback on specific processes or touchpoints.

5. Analysis Approach

Relationship NPS analysis uncovers overall loyalty trends, often broken by demographics or market segments, guiding long-term strategies and organizational adjustments.

Transactional NPS analysis dives into specific touchpoints, identifying areas for immediate improvement, such as training needs or process refinements.

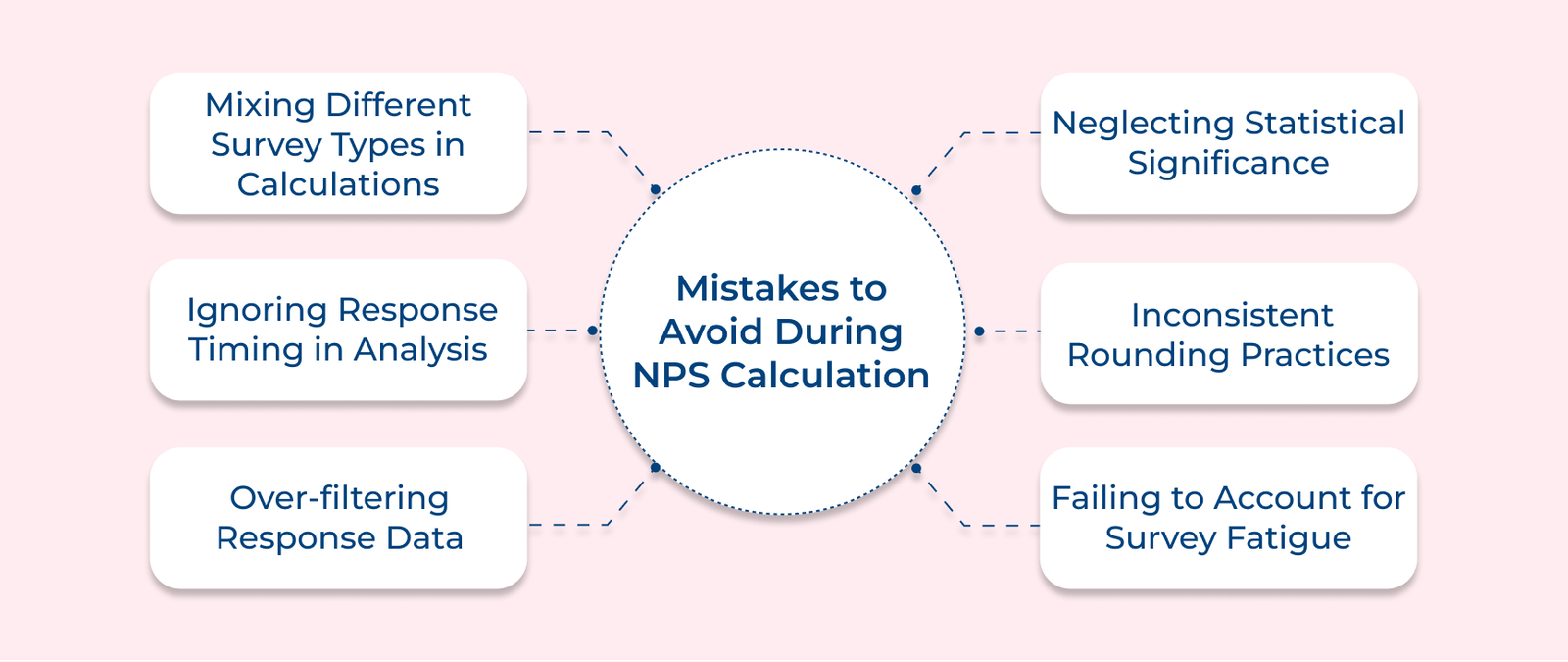

Check out the most common mistakes businesses make while calculating their NPS and learn how to avoid them to ensure you always get accurate results.

Mixing relationship and transactional NPS responses into one score distorts results by merging different feedback types. Each survey measures unique aspects of the customer experience and should be analyzed separately for accurate insights.

Failing to account for when responses were collected can skew results. Let’s assume that using data from different periods in a quarterly NPS calculation distorts trends. Always analyze feedback within its correct time frame for accurate insights.

Excessive data cleaning can introduce bias into your NPS scores. Let’s consider that removing neutral responses or excluding certain segments misrepresents customer sentiment, leading to skewed or misleading results.

Rushing NPS calculations without sufficient sample sizes can lead to unreliable results. Let’s assume that small segments with inadequate responses may skew conclusions. Ensure your sample size is statistically significant before analyzing.

Inconsistent rounding methods across teams can distort NPS calculations. Let’s assume that some may round percentages early, while others round the final score. Set clear, documented rounding rules for consistency.

Sending too many surveys can lead to rushed or careless responses. Establish a balanced survey schedule and monitor response patterns to ensure you’re gathering thoughtful, meaningful feedback.

Explore the key questions for your NPS survey to ensure you capture valuable insights. The questions will help you better understand customer loyalty.

“How likely are you to recommend [Company/Product/Service] to a friend or colleague?”

You can measure your overall customer loyalty and satisfaction through this question. It serves as a standardized metric for industry comparisons and tracking customer sentiment consistently over time.

“What is the main reason for your rating?”

The open-ended follow-up uncovers the key factors behind customer satisfaction or dissatisfaction. Businesses can focus on improvements and leverage strengths that truly matter to customers.

“How well does our [product/service] meet your needs?”

The question is used to understand the gaps between customer expectations and actual delivery. You can guide your product development and service improvements by pinpointing areas where customer needs are unmet.

“How satisfied were you with your recent customer support interaction?”

The question assesses your support team’s effectiveness by giving the much-needed insights to optimize processes and identify training needs for customer service representatives.

“How would you rate the value for money of our [product/service]?”

Businesses can gauge their customer’s views on their pricing. It can help them refine pricing strategies and identify opportunities to better communicate their value proposition.

“What one thing should we do to improve your experience?”

The question provides actionable insights, helping prioritize improvements by pinpointing the changes that will most enhance customer satisfaction.

“What additional products or services would you like us to offer?”

The question uncovers customer needs and expectations. The responses guide product development, service expansion and identifying potential market opportunities.

Calculating your Net Promoter Score offers a clear path to understanding and improving customer loyalty. Businesses can pinpoint strengths and areas for improvement in the customer experience by analyzing feedback through well-designed surveys. The data-driven approach turns customer sentiment into actionable insights. The success of NPS programs relies heavily on proper implementation of best practices, from survey design to data analysis, while avoiding common pitfalls that could distort results.

When businesses combine relationship with transactional NPS, it gives them holistic view into their customer loyalty. The dual approach, along with industry benchmarking, empowers them to create targeted strategies that boost customer satisfaction and enhance growth through better customer relationships.

First categorize survey responses into Promoters (9-10), Passives (7-8) and Detractors (0-6) to calculate NPS in Excel. Use COUNT functions to tally each group, then apply the formula: (Promoters% – Detractors%) × 100. Excel’s percentage formatting ensures clear, easy-to-read results.

Net Promoter Score (NPS) measures customer loyalty by asking: “How likely are you to recommend our company?”. Responses (0-10) classify customers as Promoters (9-10), Passives (7-8), or Detractors (0-6). NPS equals percentage of Promoters minus percentage of Detractors. Unlike satisfaction metrics that measure past experiences, NPS predicts future customer behavior and growth potential.

A good NPS score is relative to your industry. Generally, any positive score (above 0) is acceptable, 50+ is excellent, and 70+ is world-class. In highly competitive industries like telecommunications, even scores around 20 might be strong. While luxury brands often exceed 70. The most valuable comparison is against direct competitors and tracking your own score’s improvement over time.

NPS is crucial because it correlates strongly with business growth. Research shows companies with high NPS outperform competitors by 2x in revenue growth. The single question format ensures high response rates compared to lengthy surveys. NPS also captures emotional loyalty beyond transactional satisfaction, identifying customers who actively advocate for your brand. It provides an organization-wide metric that different departments can rally around to improve customer experience.

Companies prioritize improving NPS scores because higher scores directly correlate with increased customer retention, which is typically 5-25 times less expensive than acquiring new customers. NPS improvements also lead to more word-of-mouth referrals, reducing marketing costs. The metric helps identify specific pain points in customer journeys that need fixing. Companies with sustained NPS growth often see corresponding increases in share prices, making it valuable for investor relations.

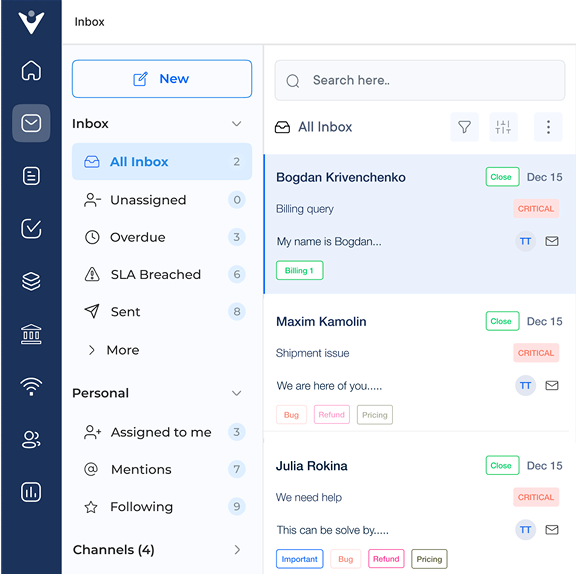

Market better, sell faster and support smarter with Veemo’s Conversation Customer Engagement suite of products.

Unify all your customer data in one platform to deliver contextual responses. Get a 360 degree view of the customer lifecycle without switching tools.

Connect with the tools you love to reduce manual activities and sync your business workflows for a seamless experience.

https://veemo.io/wp-content/uploads/2025/12/customer-connection.png

1256

2400

Indrasish Singha

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

Indrasish Singha2026-02-06 09:11:372026-01-19 09:14:05What is Customer Connection: Mistakes, Metrics & Examples

https://veemo.io/wp-content/uploads/2025/12/customer-connection.png

1256

2400

Indrasish Singha

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

Indrasish Singha2026-02-06 09:11:372026-01-19 09:14:05What is Customer Connection: Mistakes, Metrics & Examples https://veemo.io/wp-content/uploads/2025/12/complaint-management.png

1256

2400

Indrasish Singha

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

Indrasish Singha2026-02-03 09:04:022026-01-19 09:10:02What is Complaint Management? Importance, Key Steps & Strategies

https://veemo.io/wp-content/uploads/2025/12/complaint-management.png

1256

2400

Indrasish Singha

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

Indrasish Singha2026-02-03 09:04:022026-01-19 09:10:02What is Complaint Management? Importance, Key Steps & Strategies https://veemo.io/wp-content/uploads/2025/12/AI-Self-Service.png

1256

2400

Indrasish Singha

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

Indrasish Singha2026-01-26 09:52:482026-01-13 10:17:07What is AI Self Service? Benefits, Key Metrics and Best Practices

https://veemo.io/wp-content/uploads/2025/12/AI-Self-Service.png

1256

2400

Indrasish Singha

https://veemo.io/wp-content/uploads/2024/11/veemo.svg

Indrasish Singha2026-01-26 09:52:482026-01-13 10:17:07What is AI Self Service? Benefits, Key Metrics and Best PracticesGrow Customer Relationships and stronger team collaboration with our range of products across the Conversational Engagement Suite.

360 Degree Feedback & Evaluation: The Comprehensive Guide

Scroll to top

360 Degree Feedback & Evaluation: The Comprehensive Guide

Scroll to top