1. Build Comprehensive Stakeholder Relationship Maps

Sales teams must deeply understand organizational dynamics to navigate complex approval processes and build strong ties with influencers who shape deal outcomes. The process starts with identifying decision-makers and influencers within target organizations.

Communication preferences and engagement priorities guide strategic outreach throughout the deal cycle. Sales teams create personalized engagement plans based on each stakeholder’s roles and influence, documenting optimal contact methods.

Actionable tips:

- Use digital tools like Lucidchart or Microsoft Visio to map stakeholder relationships and keep them updated.

- Review stakeholder engagement metrics monthly to spot gaps and strengthen relationship-building efforts.

2. Establish Clear Deal Qualification Criteria

Deal qualification criteria help sales teams focus on high-potential opportunities by eliminating subjective decision-making. Clear qualification frameworks ensure consistent evaluation of deal viability across market segments. Minimum deal value thresholds act as filters, while historical deal data helps establish baseline requirements for different products and markets.

Organizational fit metrics assess alignment between potential clients and internal capabilities, using scored criteria to evaluate technical compatibility. Documenting resource needs forecast staffing requirements, ensuring adequate support throughout the deal lifecycles.

Pro tips:

- Develop a weighted scoring matrix to objectively evaluate deal qualification factors.

- Use automated deal qualification checklists in CRM systems to standardize the evaluation process.

3. Create Standardized Deal Documentation Templates

Standardized documentation templates simplify deal management by ensuring consistency and completeness across client interactions. The templates reduce administrative tasks, maintain professionalism and enable smooth collaboration between team members throughout deal cycles.

Version control ensures document integrity, with clear audit trails maintained through systematic naming conventions and approval workflows. Cloud-based systems support real-time collaboration and preserve version histories for future reference.

Best practices:

- Build a centralized template library with section-specific guidelines and examples for various deal types.

- Use automated version tracking with clear naming conventions to maintain document history.

4. Implement Regular Deal Review Meetings

Regular deal reviews offer structured opportunities for teams to assess progress and address challenges proactively. Consistent reviews keep deals on track, ensure stakeholder alignment and enable timely intervention when issues arise.

Resource allocation tracking ensures optimal use of capabilities, monitoring time investments and support needs across deals. Regularly assessing the deals also keep the workload balanced.

Actionable tips:

- Hold bi-weekly deal review sessions with standardized agendas to ensure consistency and focus.

- Use digital dashboards to monitor key deal metrics in real-time.

5. Develop Value-Based Pricing Strategies

Implementing value-based pricing strengthens a business’s positioning by aligning costs with the impact delivered. Unlike traditional cost-plus models, it allows sales teams to capture fair value while showcasing a deep understanding of client goals.

Clear delivery timelines set expectations for value realization, with project plans outlining phases and specific milestones. Pricing models align with delivery schedules, offering flexibility to match client budget cycles and ensure smooth implementation.

Pro tips:

- Create interactive ROI calculators with benchmarks to highlight value during client discussions.

- Develop tiered pricing models tied to specific value delivery milestones.

6. Monitor Deal Pipeline Health Metrics

Pipeline health monitoring offers valuable insights into deal management and resource optimization. Regular metric analysis helps proactively identify bottlenecks and supports data-driven decision-making for better pipeline management.

Resource utilization analysis ensures sales capabilities are deployed effectively. Teams track time investments across different deal stages and client segments, using pattern analysis to improve efficiency.

Actionable tips:

- Generate weekly pipeline health reports with key metrics and trends for leadership review.

- Set up automated alerts for deals that exceed average stage duration thresholds.

7. Create Detailed Implementation Planning Processes

Implementation planning ensures a smooth transition from deal closure to value delivery, minimizing risks and establishing clear accountability for long-term client success. Defining project milestones creates clear a roadmap for success.

Clear communication protocols define touchpoints and reporting schedules, ensuring ongoing client engagement. Success measurement criteria establish benchmarks to assess implementation effectiveness and client satisfaction.

Pro tips:

- Create milestone templates with predefined checkpoints for various solution types.

- Implement automated milestone tracking systems with notification workflows to keep projects on track.

8. Build Cross-Functional Deal Support Teams

Cross-functional support teams bring essential expertise throughout complex deal cycles, ensuring consistent access to specialized knowledge and clear accountability for deal execution. Role clarity establishes ownership for specific deal components, with responsibility matrices defining all aspects of deal management.

Escalation paths outline structured processes for issue resolution, ensuring challenges are addressed at the right organizational levels. Ongoing reviews of escalation effectiveness help improve response times and maintain client satisfaction.

Best practices:

- Create RACI matrices for different deal types to clarify team responsibilities.

- Use digital collaboration platforms with workflow management features to streamline processes.

9. Establish Risk Assessment Frameworks

Risk assessment frameworks provide a systematic approach to identifying and managing potential deal challenges. Structured evaluations help teams anticipate obstacles and develop proactive strategies to safeguard deal value. Deal-scoring mechanisms assess risks across multiple dimensions, with weighted systems based on historical data and industry benchmarks.

Regular updates ensure risk evaluation adapts to changing market conditions. Mitigation strategies address identified risks with structured response plans. Teams use templates for proven solutions while maintaining flexibility to adapt to unique situations.

Actionable tips:

- Create risk assessment scorecards with weighted factors for various deal types.

- Develop a risk mitigation playbook with strategies for common challenges.

10. Develop Post-Deal Review Systems

Post-deal review systems capture key insights for continuous improvement in deal management. Structured evaluations help teams learn from past experiences and refine strategies for future opportunities. Success measurement frameworks track deal outcomes against initial objectives, using key performance indicators throughout implementation.

Improvement tracking ensures the systematic application of lessons learned. Teams document insights in centralized knowledge bases and hold regular review sessions to share successful strategies.

Pro tips:

- Hold quarterly post-deal review sessions with standardized evaluation criteria.

- Create digital knowledge repositories to capture and share deal management insights.

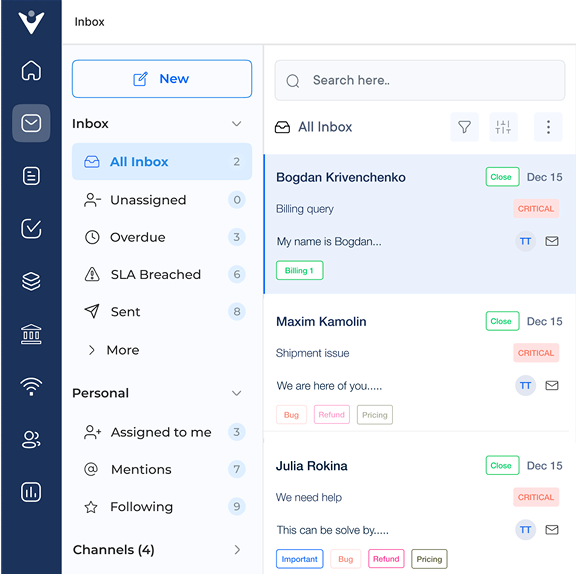

Features of Deal Management Solution

Check out the key features of a deal management solution and explore how each one can significantly enhance your sales processes.

Key questions to consider:

- How much customization does your deal process need?

- How many team members require access to deal data?

- What integrations are essential with your current systems?

- What is your budget for software implementation?

- How complex are your reporting needs?