1. Personalize Digital Services For Individual Needs

Personalization is crucial in banking as customers expect tailored services that align with their unique financial needs. Banks must move beyond one-size-fits-all approaches to create customized experiences that enhance deeper engagement and loyalty. Eight in 10 (77%) banking leaders said personalization leads to increased customer retention.

Banks can personalize product recommendations by analyzing customer transactions and life events. If a customer makes regular payments to a property management company, the bank can suggest mortgage options or home-buying guides. AI can refine the insights by predicting future needs. Custom dashboard views also help as they highlight investment tools for active traders or budgeting features for those focused on saving.

Pro tips:

- Use behavioral triggers to offer services at the right time

- A/B test personalization features to determine what resonates with different customer segments.

2. Streamline Omnichannel Banking Experience Seamlessly

Modern banking customers expect seamless interactions across various channels, from mobile apps to physical branches. A streamlined omnichannel experience ensures consistent, high-quality services regardless of how customers choose to bank.

If a customer starts a mortgage application online, they should be able to continue it seamlessly at a branch without re-entering their details. This kind of integration saves time and builds trust by making the process effortless. A true omnichannel experience depends on syncing customer data across all touchpoints.

Actionable tips:

- Prioritize a mobile-first approach, as most customers engage with smartphones.

- Develop a universal design system that ensures consistency across all banking platforms, while respecting each channel’s unique strengths.

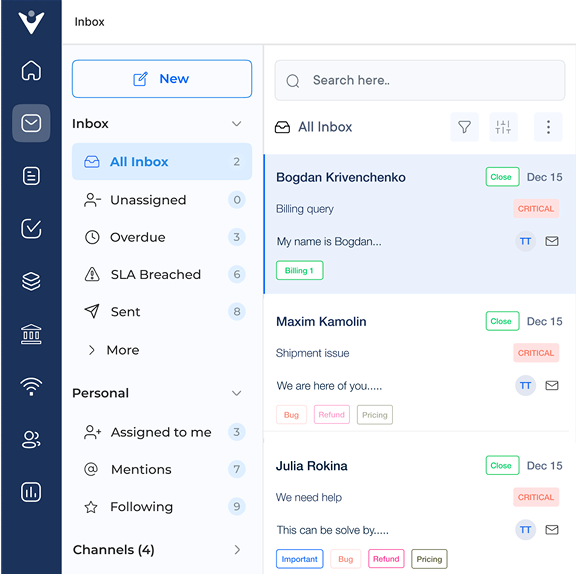

3. Deflect from IVR to Digital Channels

The shift from traditional Interactive Voice Response (IVR) systems to digital channels marks a crucial step in enhancing banking customer service. The strategy not only reduces call center volumes but also caters to customer preferences for faster, digital interactions, leading to improved satisfaction.

Smart call routing improves customer service by recognizing common patterns. Imagine if a customer often calls about the credit unions issue, they can be directed to a specialized support team or digital self-service options. During peak hours, IVR can suggest faster online solutions to reduce wait times. Click-to-chat features also help by connecting callers to instant support through mobile apps or websites, ensuring quick assistance without losing the human touch.

Best practices:

- Analyze IVR exit points to address customer abandonment and design targeted digital solutions.

- Add a callback feature, enabling customers to schedule digital support sessions instead of waiting on hold.

4. Implement Proactive Customer Support Systems

Proactive customer support shifts banking from reactive to preventive services, anticipating potential issues using advanced monitoring and predictive analytics. The approach builds trust, reduces support requests and mitigates financial risks.

Automated alerts for unusual account activity help customers spot suspicious transactions such as multiple international transfers. The real-time notifications act as an early warning against fraud. Banks also use alerts for service disruptions, informing customers about maintenance or technical issues. Offering alternative ways to complete transactions ensures uninterrupted access to banking services.

Pro tips:

- Prioritize notifications based on customer preferences and transaction history.

- Implement a feedback loop to refine alert effectiveness and adjust communication strategies based on customer responses.

5. Enhance Mobile Banking App Functionality

Mobile banking has shifted from a convenience to a necessity, with smartphones becoming the primary channel for most customers. Banks must continuously enhance their mobile apps to meet rising expectations and stay competitive.

Biometric security, like fingerprint scanning and facial recognition, makes logging in faster and safer as there are no more complicated passwords. Real-time transaction alerts help customers track spending, freeze cards and stay in control of their finances. Voice commands make banking even easier, letting users check balances, transfer money and pay bills hands-free.

Key takeaways:

- Add offline functionality for recent transactions and ATM location searches.

- Implement a customizable quick-action menu for easy access to frequently used features.

6. Develop Seamless Onboarding Authentication Processes

The onboarding process is a critical first impression that sets the tone for a customer’s entire banking experience. Banks must ensure security while offering a convenient frictionless account opening experience.

Digital ID verification has made onboarding faster and easier. Customers can scan their government-issued ID with a smartphone, allowing OCR technology to extract and verify detail. Once verified, accounts are activated instantly, giving immediate access to banking services. A step-by-step guide helps users set up deposits, download the mobile app and customize their banking preferences.

Pro tips:

- Use a progress bar to show exactly customers where they are in the process and how much is left.

- Implement a “save and resume” feature so customers can pause and continue the onboarding process.

7. Balance Digital and Human Service

Balancing digital efficiency with the human touch is essential in modern banking. While digital services provide convenience and speed, complex financial decisions often benefit from personalized, empathetic human support.

A seamless transition from digital to human support is key. When a customer faces a complex issue on the mobile app, they should quickly connect with a banker who understands their digital journey, eliminating the need to repeat information or restart processes.

Best practices:

- Train staff to guide customers toward self-service tools when appropriate.

- Implement screen-sharing sessions to help customers through complicated digital processes.

8. Leverage Data Analytics for Customer Insights

Data analytics in banking turns customer data into actionable insights that drive service improvements. Banks can tailor solutions and anticipate needs by understanding behavior, staying ahead of customer needs.

Tracking customer interactions across channels reveals valuable patterns. Let’s consider that if customers who use mobile check deposits also adopt other digital services, banks can target them with relevant campaigns. Predictive modeling helps anticipate future needs, offering investment options to customers with high checking balances, enhancing deeper engagement.

Pro tips:

- Segment customers based on behavior, not just demographics.

- Use real-time analytics dashboards for data-driven decisions during customer interactions.

9. Solicit Transparent Communication Feedback Loops

Implementing effective feedback mechanisms ensures banks stay in tune with customer needs and expectations. Regular feedback helps identify service gaps and improvement opportunities, building trust.

Providing multiple feedback options meets different customer preferences. Quick surveys after mobile transactions capture immediate reactions, while detailed forms offer deeper insights. The approach gathers a wide range of opinions. Acting on feedback like improving mobile check deposits based on user input shows the bank is listening and making real changes.

Actionable tips:

- Use a visible feedback tracking system to show customers how their input drives change.

- Create a customer advisory board to provide structured feedback before major updates.

Real-life Examples of Improving Customer Experience in Banking

Following are some real-world examples that demonstrate how financial institutions are successfully transforming their approach to meet changing customer expectations (CX).

1. DBS Bank (Singapore)

DBS Bank has revolutionized customer experience with its “Live more Bank less” philosophy, leveraging predictive AI to anticipate customer needs. DBS has made banking virtually invisible by integrating banking services into everyday activities like shopping and travel through their lifestyle app.

2. Capital One (United States)

Capital One has redefined banking with its Banking Cafes, blending traditional services with a modern coffee shop vibe. Customers can enjoy beverages while receiving financial advice and the AI-powered virtual assistant, Eno provides 24/7 personalized support.

3. Monzo Bank (United Kingdom)

Monzo has revolutionized banking with its mobile-first approach, offering instant spending alerts, real-time budgeting and shared savings pots. Their transparency shines through by publishing product roadmaps and integrating customer feedback. The customer-centric strategy has built a loyal customer base of engaged users, especially millennials and positioned Monzo as a trusted financial partner.

4. BBVA (Spain)

BBVA has successfully blended digital innovation with personal service, strengthening its market position. Their heavy investment in digital transformation includes advanced mobile banking features like personalized financial health scores, product recommendations and seamless digital account openings.

5. ING (Netherlands)

ING combines seamless digital experiences with personal connections through video banking services. Their advanced authentication methods, including voice recognition and behavioral biometrics, enhance security, while predictive features in their mobile app help customers manage finances proactively.

Main Challenges In Improving Banking Customer Experience (CX)

The following are the main challenges in improving the banking customer experience (CX), which requires balancing technology, security and accessibility to meet customer expectations.